Market conditions are primed for US nitrogen producers to maintain a urea-heavy product mix through June.

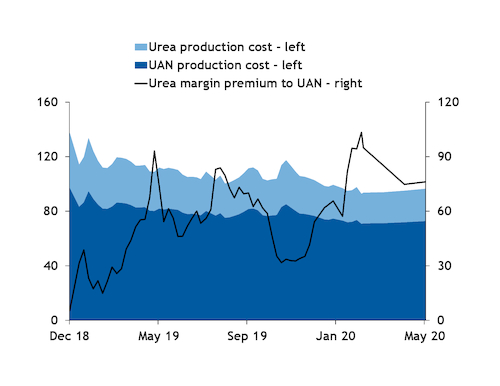

Urea is likely to provide a higher return to producers instead of UAN through the first half of the year, based on an Argus analysis of production costs and futures contracts.

Producers selling urea at Nola should capture between $75-$95/st more than UAN between March and June. That premium is about $18-$38/st wider than what was achievable throughout January, Argus estimates.

Leading producer CF Industries this year has already reduced UAN production in response to record-low prices driven by excess supply.

Aside from production economics there remains a supply-side incentive for US producers to favor urea output ahead of spring demand.

Urea imports to the US through April are estimated nearly 1mn t below the prior fertilizer year, and delays to several vessels originally scheduled to arrive in March are anticipated to discharge at the port of New Orleans, Louisiana, no earlier than the first half of April.

The deficit in offshore urea imports is likely to lend additional price support at Nola in March and April and enable producers to meet the perceived supply shortage while capturing higher product values.

But UAN could reclaim its attractiveness to producers once growers have planted this season's corn crop. UAN is a preferred nitrogen source for side-dress applications throughout the Midwest, mostly between late-April and early-June, but can be applied as late as July.

Growers will need to consume current retailer and wholesaler inventories before distributors return to the spot market for replacement orders. But UAN consumption, as with total nitrogen use, is forecast to rise from last year on increased corn area of 91mn-94mn acres, according to industry estimates.

Any delays to pre-plant applications or seeding should further lend to higher UAN consumption, supporting late-season values because of how late the product can be applied.