Fuel demand is recovering after the coronavirus outbreak but throughput levels are threatened by sharply lower export margins

Chinese refinery runs are likely to rise this month. Product inventories are dropping following a partial recovery in commercial activity, creating space for refiners to raise throughputs.

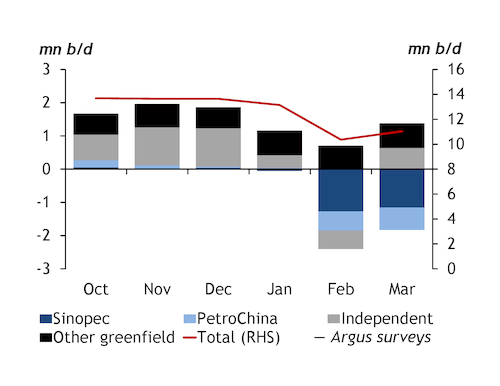

Crude runs are on course to grow by 1mn b/d on the month to 11mn b/d in March, Argus surveys indicate. Chinese gross product worth refining margins have risen — on paper, at least — to $9/bl this month, from just 7¢/bl in February as demand collapsed. This has prompted some refiners to defer maintenance planned for March, and spurred several Shandong independent plants to restart idled units. About 820,000 b/d of crude unit capacity is due to shut this month, compared with original plans for March shutdowns totalling 900,000 b/d of capacity.

Sinopec is raising runs mostly in east China — around Shandong and Shanghai. The company appears to have shelved a major turnaround at its Zhenhai refinery near Shanghai in response to improving margins and will process at least 80,000 b/d more crude this month overall than in February, or 4mn b/d. But it has cut runs at its 260,000 b/d Gaoqiao refinery in Shanghai ahead of a shutdown of the plant's fluid catalytic cracking unit in April.

CNOOC has increased throughputs at its 440,000 b/d Huizhou refinery in southern Guangdong province to 400,000 b/d this month from 375,000 b/d in February. Private-sector textile giants Hengli and Rongsheng are running their 400,000 b/d Dalian and Zhoushan refineries at 100pc and above 95pc, respectively, in March. Both plants ran at 90pc in February. PetroChina's crude runs at 25 refineries will be slightly lower than in February, at 2.78mn b/d. Its 200,000 b/d south coast Qinzhou refinery remains off line for a turnaround, more than compensating for a slight increase in crude runs at other plants.

Feeling the squeeze

State-owned Norinco has reduced the utilisation rate at its 120,000 b/d Huajin refinery in northeast Liaoning province to 75pc from 77pc in late February. The rise of Hengli as a refiner, and relatively high run rates at its Dalian complex in February-March, are squeezing other refiners in the northeast.

But fuel demand is recovering in China as the central government eases travel restrictions and encourages people to return to work. Diesel demand is expected to lead the recovery, with domestic demand 11.4pc lower this month from a year earlier, according to estimates by CNPC think-tank the China Petroleum Planning and Engineering Institute (CPPEI). Diesel demand last month was down by 37.4pc on the year, the CPPEI says. Demand for gasoline will rebound in April-May, it predicts, with jet fuel rebounding after May. Demand for these fuels shrank by 22.5pc and 44pc on the year, respectively, this month.

Rising exports are helping erode China's swollen product stocks. But product export margins are falling dramatically, posing a threat to the resumption of usual throughput levels at refineries. Jet fuel crack spreads in Asia-Pacific are at multi-year lows, as the global spread of the coronavirus grounds aircraft.

Sinopec's 460,000 b/d Zhenhai refinery exported 270,000t last month, up by 69pc on the year. Exports from its Gaoqiao and Yangzi refineries rose by 51pc and 99pc, respectively. Diesel and jet fuel exports from the Sinopec-Aramco-ExxonMobil Fujian joint-venture refinery increased by 80pc on the year to 300,000t between 1 January and 13 March. PetroChina exported the first cargo of diesel from its Fushun refinery in northeast Liaoning province in early March. CNOOC exported this year's first cargo of diesel from its Daxie Zhoushan plant in early March and plans to double gasoline exports from its Zhongjie refinery in northern Hebei province to 60,000 t/month.