Russian state-controlled Gazprom's pipeline deliveries to Europe, excluding the Baltic states and Turkey, slipped over the past week or so, as weather-adjusted demand fell across much of Europe because of measures to contain the spread of the coronavirus.

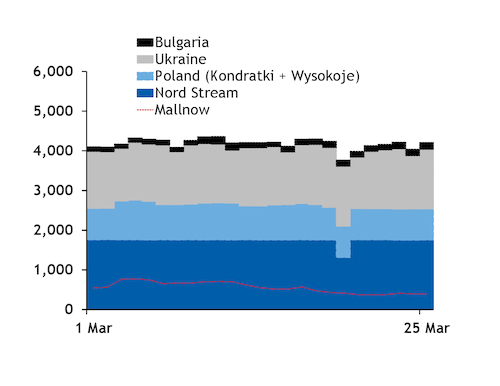

Flows to Europe at the Nord Stream link's German exit point in Greifswald, the Polish entry points of Kondratki and Wysokoje, all Ukrainian exit points and the Strandzha-2 point between Bulgaria and Turkey slowed to 4.08 TWh/d on 19-25 March (see flows graph).

This was down from 4.23 TWh/d a week earlier, which was stable against earlier in the month.

Deliveries may have included Ukrainian exports of supply from storage. Net withdrawals at Ukrainian sites averaged 87.5 GWh/d on 19-25 March, and 6.6 GWh/d earlier in the month. And they could also have included supply sent to and from Poland, Slovakia or Hungary transiting Ukrainian border points under the ‘short-haul' programme offered by Ukraine's system operator, GTSOU.

Gazprom could supplement physical deliveries to Europe with supply drawn from European storage. But stock movements at some sites where Gazprom holds capacity, including Bergermeer in the Netherlands, also slowed over the past week, while they were unchanged at some others where the firm has space, such as Germany's Rehden, Austria's Haidach and the Czech Republic's Damborice. That said, Gazprom probably holds capacity at a number of other facilities, especially given that it had targeted much higher stocks ahead of this winter compared with previous years.

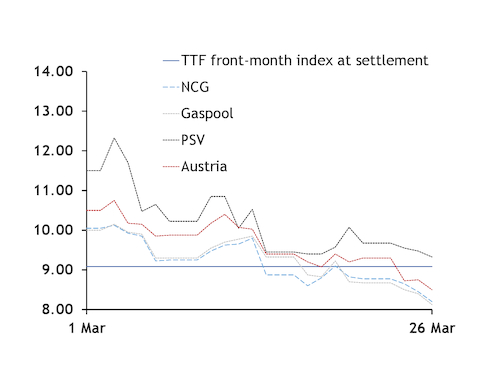

Prompt prices at a number of northwest, central and eastern European hubs have in recent weeks, opened wide discounts to the TTF front-month index's settlement for March of €9.084/MWh, after starting the month above it (see 'incentive' graph). This may have encouraged firms with long-term supply contracts tied to the index, particularly in northwest Europe, to turn down deliveries.

European prompt prices have come under pressure from weaker demand as a result of measures to curb the spread of the coronavirus. Such measures have resulted in weather-adjusted consumption falling in the last week or so. Offices and institutions such as schools and universities remaining closed has cut into deliveries to local distribution networks. And industrial activity has fallen in some countries, such as Italy and Germany, where a number of large sites have closed.

That said, prompt prices in some countries have remained above the TTF hub's front-month settlement. The Italian PSV day-ahead market has retained a premium, despite lower demand, although it has also moved considerably closer to the index's settlement in recent weeks. And deliveries at Tarvisio — where mostly Russian gas arrives in Italy — have remained strong.