A weak demand outlook pressured South Korean coal prices this week, although the market remains busy, with fresh term tenders launched by state utility Korea South-East Power (Koen) today.

Argus' NAR 5,800 kcal/kg cfr South Korea price assessment fell by $0.54/t on the week to $63.39/t ($66.45/t basis NAR 6,080 kcal/kg). NAR 5,800 kcal/kg fob Newcastle coal — which is a major component of South Korean seaborne demand — fell by $3.46/t to $56.31/t ($59.03/t basis NAR 6,080 kcal/kg).

Restrictions to slow the spread of Covid-19 have weighed on South Korean electricity demand recently, compounded by unseasonably mild temperatures.

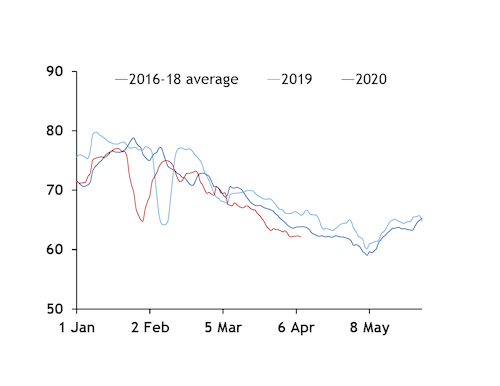

Daily peak power demand typically falls through the first four months of the year, before rebounding from early May as the cooling season begins. The seasonal lull in demand is likely to be particularly severe this year because of the coronavirus, with peak electricity consumption already trending below 2019 and the 2016-18 average since early March (see chart).

South Korea put in place a strict 15-day social distancing policy on 21 March, which has been extended by two weeks to 20 April. The policy has led to the closure of schools and high-risk public facilities, while offices have been urged to shut and employees have been asked to work from home. Officials confirmed 53 new cases on 8 April, bringing the total number of confirmed coronavirus cases to 10,384.

The weather is also offering little support to power demand, with the Korean Meteorological Administration saying there is only a 10-20pc chance of below-average temperatures through to mid-May.

But coal demand may prove to be more resilient than natural gas this spring. There is potential for fewer plant shutdowns in April-June than in 2019, following heavy disruption during the winter, and coal prices continue to offer a competitive advantage over state incumbent Kogas' domestic gas tariff, which tracks oil-linked LNG prices closely.

Kogas' power-sector tariff is around $10.05/mn Btu for April, which implies a generation cost of around $63.50/MWh for a 55pc-efficient gas-fired plant. Coal-fired generation at 38pc-efficient plants would be around $39/MWh based on Argus' latest cfr South Korea price assessment.

Kogas has asked its suppliers to delay a swathe of May-October LNG deliveries as it grapples with high stocks and soft demand, according to market participants. But other South Korean buyers remain in the market for spot cargoes, which at $16-17/MWh still price competitively against coal for power generation.

State utilities are also seemingly open to further coal procurement, with Koen tendering for 4.50mn-4.86mn t of various grades of thermal coal for delivery through to 2022, including up to around 700,000t of min. NAR 5,600 kcal/kg coal loading over June-September 2020.