Algeria's state-owned Sonatrach is offering a spot LNG cargo for delivery in May and plans to offer more cargoes for delivery later this summer as exports of pipeline gas and LNG remain slow.

The firm was offering a May-loading cargo either on a fob basis or for delivery in the Mediterranean, market participants said. Sonatrach typically seeks bilateral contacts with several potential customers rather than issuing official tenders. The firm initially considered offering a string of summer cargoes, but opted to withhold offers for later in the summer as it expected a number of US cancellations to tighten Atlantic basin supply and provide scope to achieve higher prices, some market participants said.

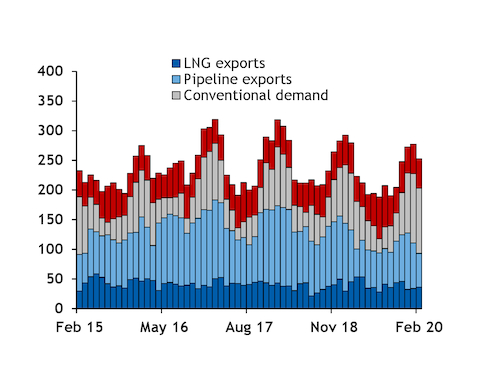

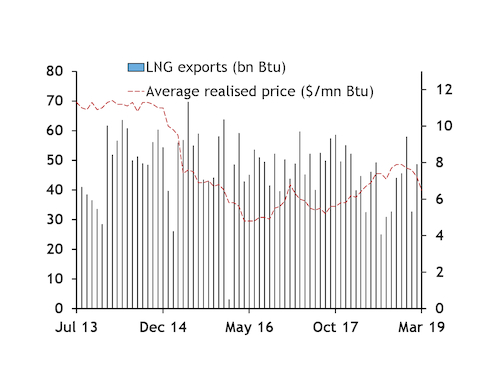

Algerian LNG exports slowed further in recent weeks. Loadings fell to 759,000t of LNG on 1-20 April from 947,000t a year earlier, shiptracking data show. LNG exports started slowing at the beginning of the year — with a total of 2.73mn t exported in January-March, down from 3.1mn t a year earlier and the three-year average for the period of 2.86mn t — despite some of Algeria's long-term customers absorbing more supply. France and Turkey received brisker Algerian deliveries in the first quarter of the year.

By contrast, deliveries to Spain have all but stopped, after slowing in 2019, partly as a result of Spanish firm Endesa's 300,000 t/yr contract expiring at the end of last year. And Greece has only received one Algerian cargo so far this year, as oil-linked prices under state-owned firm Depa's 720,000 t/yr contract with Sonatrach provide an incentive to defer deliveries until later in the year, market participants said. Depa negotiated a temporary reduction in the contractual volume to 440,000 t/yr for 2019.

Algeria has been exporting LNG only through the 21.9mn t/yr Arzew terminal since December, when the 9.2mn t/yr Skikda facility halted for maintenance. But loadings were still higher than a year earlier in January and Arzew had capacity to ramp up exports further.

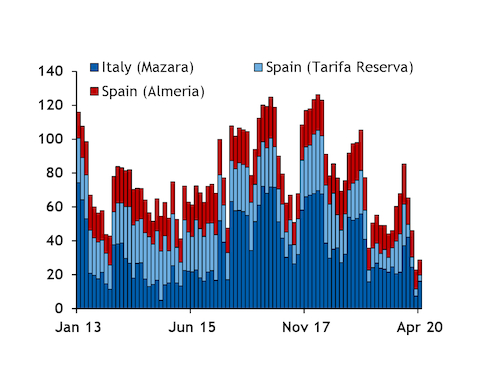

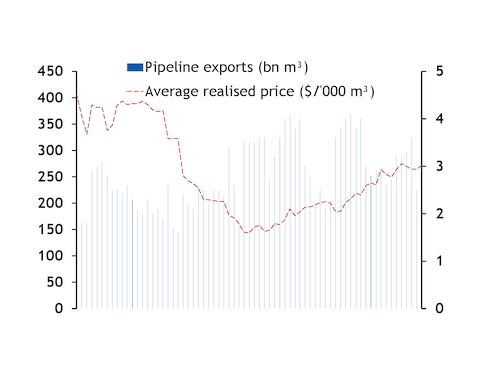

The recent drop in oil prices could also encourage Algeria's long-term pipeline customers to defer deliveries until later in the year. Aggregate pipeline flows to Spain and Italy fell to a record low for any month of 22.8mn m³/d in March, before edging higher to 28.7mn m³/d on 1-20 April. Deferring Algerian pipeline imports has allowed Spain and Italy to cope with the drop in industrial and power sector gas demand in recent weeks, as both countries experienced strict lockdown regimes to contain the spread of Covid-19, while maintaining brisk LNG deliveries. But it was unclear to what extent flows will have to ramp up later this year, as several long-term pipeline contracts expired at the end of last year and were replaced by new agreements. And Spanish regulator CNMC previously expected LNG to continue displacing Algerian pipeline imports over the next decade.

The drop in export demand may have led Sonatrach to further reduce upstream production, despite domestic demand growth accelerating in recent months. Upstream production fell to 274mn m³/d in January-February from 296mn m³/d a year earlier, the Joint Organisation Data Initiative (Jodi) data show. Gas output fell as low as 197mn m³/d in July last year, the lowest for any month since at least 2014.

Algerian domestic demand rose to 163mn m³/d in January-February from 148mn m³/d a year earlier, which would equate to an 11pc increase, despite power sector gas demand falling to 49.4mn m³/d from 50.6mn m³/d, Jodi data show. Domestic demand growth accelerated to 7.8pc in 2019 from 3.3pc a year earlier, the highest consumption increase since 2015.