Greece could extend discounts to central-eastern and southeast Europe more frequently in the second half of this year, as stronger gas burn, declining generation costs, a low demand outlook and rising wind capacity pressure the country's power curve.

Greek power contracts for delivery in July-December have elicited increasing trading interest since mid-March, when preventative measures against the Covid-19 outbreak started to pressure demand and spot prices. Deals were going through at discounts to their Hungarian and Romanian equivalent and at a record-low premium to Bulgaria, traditionally the discount market in the region.

The Greek third-quarter contract last traded at €49.50/MWh in the over-the-counter (OTC) market yesterday, at parity with the Romanian equivalent today and at a €1/MWh premium to Bulgaria. The Greek contract cleared at a €0.50/MWh discount to Romania last week.

And the Greek contract for October-December delivery saw liquidity at €49.50/MWh, €1.40/MWh below the Hungarian equivalent close yesterday.

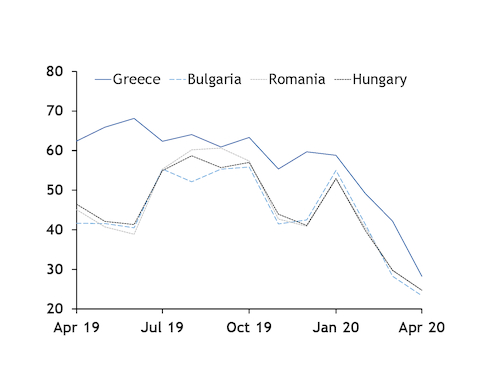

Greek month-ahead contracts traditionally hold a regional premium, having constantly cleared above their Bulgarian equivalent since late 2013. They settled below the Hungarian market only on 19 instances during the period.

But Greek spot prices cleared at €28.27/MWh on 1-23 April, considerably below any monthly average since at least 2016 (see chart). This was mainly owing to low demand, combined with high gas and wind output, pushing lignite to the margins of the power mix. Lignite-fired plants failed to enter the day-ahead market on several days in April, averaging 580MW on 1-21 April, accounting for 17.5pc of the power mix.

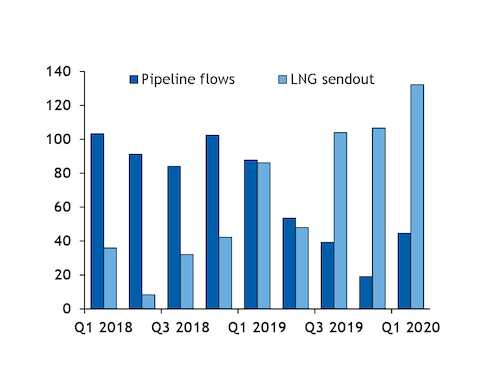

But lignite burn has seen steady declines since last year as increasing LNG supply has provided support to gas-fired generation. Pipeline imports have held a large premium to LNG deliveries, as state-owned supplier Depa's long-term agreements with oil-linked indexation have left them uncompetitive against falling global LNG prices. North-south physical pipeline flows at the Kulata border point with Bulgaria have consistently stood below LNG sendout from Revithoussa since the second half of last year. The latter averaged an all-time high of 132.22 GWh/d in the past quarter (see chart).

Greece has also prioritised spot LNG cargoes at the expense of its contractual obligations. The country has received only one Algerian cargo this year, as oil-linked prices under Depa's 720,000 t/yr contract with Algeria's state-owned Sonatrach provide an incentive to defer deliveries until later in the year. Depa negotiated a temporary reduction in the contractual volume to 440,000 t/yr for 2019.

Low demand outlook

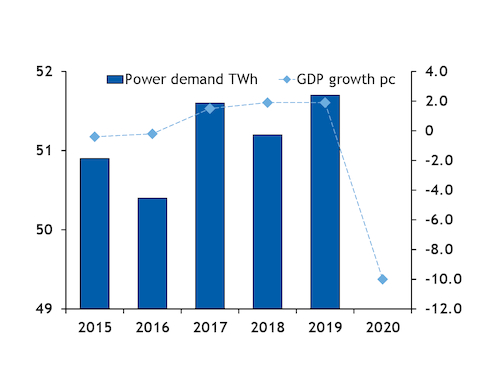

Greek power consumption could fall to record lows this year as the Covid-19 outbreak is anticipated to plunge the country's economy into its deepest recession in recent years. The IMF forecast earlier this month that the Greek economy will contract by 10pc in 2020, which would be even steeper than the 9.1pc decline recorded at the peak of the Greek financial crisis in 2011.

Greek power demand has closely aligned with economic growth during the past two decades, having peaked at around 58TWh in 2008 ahead of the financial crisis and fallen to 50.3TWh in 2013. Demand stood at 51.7TWh last year, or an average of 5.85GW, and has already declined to an average of 5.39GW this year (see chart).

Wind

Wind output has accounted for an increasing share of the Greek power mix, reflecting record capacity additions from last year.

Wind generation totalled 6.07TWh last year, accounting for 16.8pc of the power mix, up from 5.49TWh in 2018. Output at wind plants has risen to 2.55TWh this year, making up 24.5pc of the power mix, from 2.14TWh at the same time a year earlier.

Greek wind capacity rose by a record 728MW last year, largely ahead of other fuel types. Wind additions totalled 200MW in January-March, up from 138MW in the same time a year earlier.