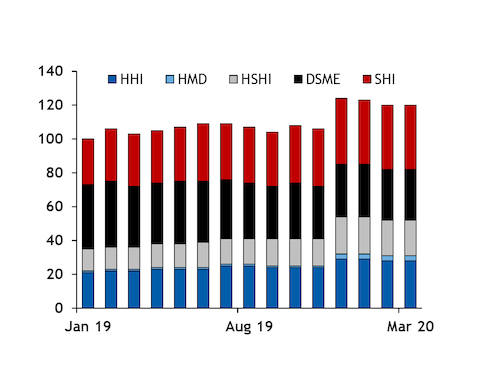

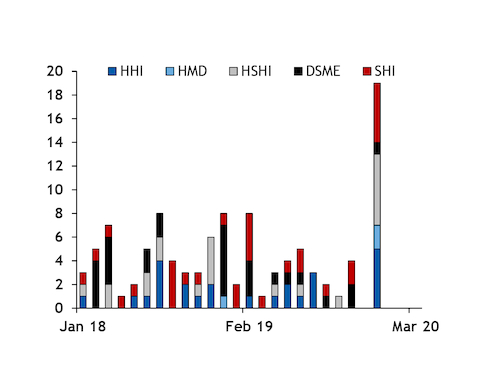

The combined LNG orderbooks for South Korea's three major shipbuilders tightened in the first quarter compared with the end of 2019, as new orders dried up.

January-March marked the longest period without new orders since at least 2018 at Daewoo Shipbuilding and Marine Engineering (DSME), Korea Shipbuilding and Offshore Engineering (KSOE) and Samsung Heavy Industries (SHI).

But this followed 19 new-build orders in December, which buoyed the builders' combined carrier backlog to 124 vessels.

Four deliveries in January-February cut the backlog to 120 by the end of March, which remained significantly higher than a year earlier, when the backlog was 103.

KSOE retained the largest unfulfilled orderbook of the three firms, with 52 vessels still to be delivered by the end of March, down from 54 in December, but up from 36 a year earlier. The firm incorporates three entities — Hyundai Heavy Industries (HHI), Hyundai Mipo Dockyard (HMD), and Hyundai Samho Heavy Industries (HSHI). HHI and HSHI delivered a single vessel each in February, while HMD — which has typically received orders for small-scale vessels in recent years — had an unchanged backlog.

DSME's backlog fell to 30 vessels in the first quarter from 31 in December, following a delivery in February. A lack of new orders meant that the firm's backlog remained lower than a year earlier, following quick vessel deliveries in 2019, including six Arc7 ice-class vessels for Russia's Yamal LNG project.

SHI's unfulfilled orderbook fell by one vessel to 38 carriers in the first quarter, following a delivery in January. The firm made a second delivery this year in April. But its orderbook remained higher than a year earlier, when the firm had a backlog of 31 vessels.

That said, the South Korean builders' combined backlogs could be buoyed by delayed deliveries. Bermuda-based owner Gaslog suggested this month that some newbuilds on the global orderbook that had initially been due for delivery this year could be delayed to 2021, as Covid-19 weighed on yard capacities. Around 40 had been scheduled for delivery later this year, the owner said, adding that it expects delayed delivery to be more prevalent for vessels not yet tied to term charter agreements.

And South Korean shipbuilders are also vying for orders tied to a number of planned liquefaction projects, notably Qatar's Ras Laffan expansion, which could further buoy orderbooks this year.

State-owned Qatar Petroleum placed an initial reservation of berths at China's Hudong-Zhonghua shipyard in April, but other shipbuilders may also receive orders, with a total of 60-100 newbuild orders expected for the Ras Laffan expansion. Hudong has capacity for around 12 per year.

And South Korean yards may also receive orders for up to 10 Arc7 ice-class carriers for Russia's 19.8mn t/yr Arctic LNG 2 project, in addition to expected orders tied to the Total-led 12.88mn t/yr Mozambique LNG project.