Updates to include power generation data throughout

A surge in Vietnamese coal imports helped absorb some oversupply in the seaborne market last month, as weak hydroelectric generation supported coal burn.

Vietnam imported a record 6.25mn t in April, up by 65.3pc on the year, customs data show. The data, which do not differentiate between coking and thermal coal, also show a rise in receipts from 4.45mn t in March.

Lockdowns in key coal-importing countries such as India slashed consumption and drove an oversupply of seaborne thermal coal, with Vietnam emerging as a key source of flexible demand able to absorb some of the surplus.

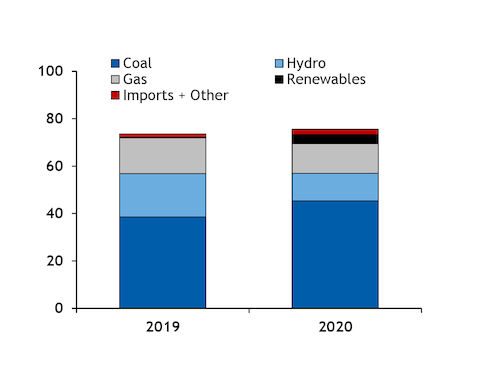

Vietnamese coal-fired power generation rose by 7.7pc on the year to 11.4TWh in April, state-owned power company EVN said. This was despite a 9.2pc decline in total generation, as weak hydro output created a deficit that coal has helped to fill in 2020.

Vietnamese hydro generation was down by 36.5pc on the year in January-April at 11.6TWh, while coal-fired generation was up by 17.6pc at 45.33TWh, EVN said. This is the equivalent of an additional 2.6mn t of NAR 5,500 kcal/kg coal burn in 40pc efficient plants in January-April.

The near-term outlook for shipments to Vietnam looks strong amid prospects of increased demand at a time when buying requirements are lower than usual in other key coal-consuming markets in Asia.

Prolonged heatwaves are expected to support power demand in May, EVN said, which may support coal use amid weak hydro availability. Vietnamese coal-fired generation is already on an upward trend, as the country commissioned 1.2GW of new capacity last year to bring its total to 19.2GW. Another 2.1GW is scheduled to come on line this year and a further 3.7GW of capacity is under construction, with commissioning set for 2021.

A dip in domestic coal supply has further tightened fundamentals in Vietnam this year, with the country's production down by 2.2pc at 12.6mn t in the first quarter.

Vietnam's imports were also facilitated by a steady easing of its nationwide social distancing directive, which started on 1 April and was imposed for two weeks.

Economic activity was resilient compared with other countries, but still slowed, with industrial production falling by 10.5pc on the year in April, the general statistics office said. Vietnam's electricity generation dipped to 17.9TWh last month, from 19.2TWh in April 2019 and 19.8TWh in March 2020.

Vietnam was a willing recipient of additional supply last month and reputedly secured cargoes at knock-down prices in March and early April, given the absence of other key buyers in the market. Vietnamese buyers were able to pick up some Indonesian and South African cargoes originally intended for India, which went into lockdown from 25 March. Some Australian coal was also targeted at Vietnam at tempting prices after demand from usual buyer China cooled amid high domestic stocks and limited requirements.

Australian coal accounted for much of last month's increase in imports, with receipts of all grades of from Australia gaining by 581,980t on the year to about 2.08mn t.

Indonesia accounted for 1.74mn t of April imports, up by around 474,521t on the year. Vietnam imported about 1mn t from Russia in April, up from 697,738t a year earlier.

Although Vietnam's provisional customs data did not show coal imports from South Africa in April, exports from the Richards Bay Coal Terminal (RBCT) to Vietnam swelled last month amid a collapse in demand from India, a key buyer of South African coal. RBCT exports to Vietnam jumped to a record 1.3mn t in April, up from 539,034t in March.

Vietnam's mid to long-term coal import outlook is positive. Hanoi's five-year socio-economic development plan for 2021-25 targets an average economic growth rate of 7 pc/yr. Its GDP grew by 3.82pc in January-March, and the government is aiming to achieve growth of over 5pc this year.

Growth in the power sector is also supporting the longer-term outlook for thermal coal imports. Around 3.2GW of coal capacity is under construction and scheduled for launch in 2022, while another 870MW is planned, with construction yet to start.