Rising forward prices have led some US shale operators to consider slowly raising output again later this year, after steep shut-ins for May-June.

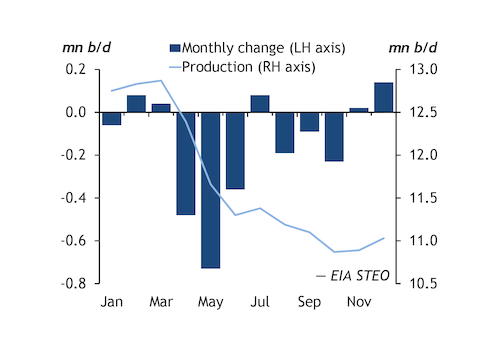

US production will have fallen by nearly 1.6mn b/d over the course of the second quarter, the EIA projects in its latest monthly Short-Term Energy Outlook (see graph). Developers have rapidly cut spending and idled rigs in the face of huge demand declines and a crude price collapse since March. Many upstream independents have withdrawn their production guidance for this year because of the uncertain macroeconomic recovery outlook.

But a recovery in forward oil prices over the past three weeks has already led some firms to talk about bringing back production towards the end of this year. December WTI futures have risen above $30/bl, a more than $3/bl increase since late April, as Opec+ output cuts take hold and preliminary demand readings point to a gradual recovery from an April low. Prominent independent EOG Resources says it may gradually raise US production to 325,000-365,000 b/d in the third quarter and 400,000-420,000 b/d in the fourth quarter. This would put its production roughly 100,000 b/d higher in October-December than in the present quarter, after it took about 170,000 b/d off stream.

Marathon Oil says it is considering renewing activity in the third quarter at current futures prices as the "maximum pain" for oil supply and demand fundamentals passes. "With the second quarter pause, the third quarter will be the trough for our 2020 production profile," chief executive Lee Tillman says.

Cuts still have some time to play out, particularly among the more financially resilient major oil firms. ExxonMobil is shutting about 100,000 b/d of oil equivalent (boe/d) of unconventional production in the Permian basin in west Texas and New Mexico this quarter. The firm is idling about three-quarters of the rigs it operates in the Permian to leave 15 in the basin at the end of this year. Chevron will cut output by 200,000-300,000 b/d in May, and may make deeper cuts in June. It says it expects its Permian output to decline by 125,000 boe/d by the end of 2020. BP has cut US onshore drilling activities to one or two rigs from an average of 13 in January-March. "In many ways, that is one of the attractive things about the business that it does provide us that flexibility to shift from 13 rigs to one rig in a matter of weeks," chief executive Bernard Looney says.

Independents' day

Cash-strapped independents' horizons are shorter term. Leverage and hedging positions largely dictate the pace of their shut-ins and drilling reductions. Occidental has pivoted its near-term operating plan to focus primarily on reducing the current 25pc base decline rate of existing fields instead of drilling new wells. The firm has cut its 2020 capital expenditure (capex) by more than half to around $2.5bn, of which it spent about $1.3bn in the first quarter. ConocoPhillips has said it will curtail about 20pc of its first-quarter volume in May and 30pc in June with a capex reduction of 35pc against its original plan. "Our underlying business is running very well," chief executive Ryan Lance says.

Concho Resources is more insulated than most from price volatility. It has hedges at $54/bl for WTI and Brent that cover slightly over 150,000 b/d of its oil production for 2020, and produced just under 210,000 b/d in the first quarter. Concho says it expects production to be flat this year compared with 2019, down from an earlier target of a 6-8pc increase. In contrast, key Bakken operator Continental Resources has shut in 70pc of its oil production in May, marking one of the steepest reductions among medium-sized independents. The firm has no derivatives cover for its oil output and its curtailments are likely to continue in June.