Steelmakers' pinched profit margins narrowed discounts for lower-grade iron ores earlier this year, and now a supply crunch is further tightening discounts in monthly adjustments.

UK-Australian mining company BHP will narrow discounts for June monthly contracts for 59.5pc Fe Jimblebar fines (JMBF) and 60.8pc Fe Mac fines (MACF), while the June discount will widen for 57.1pc Fe Yandi fines, Chinese market participants said

The JMBF floating discount will narrow to 7pc below the June 62pc index from 7.5pc in May. The MACF discount will narrow to 0.5pc below the index from 1.25pc in May. The Yandi fines floating price will be 5.5pc below the 62pc index, widening from a discount of 4.5pc in May.

Thin profit margins for mills narrowed discounts for lower-grade ores after the lunar new year holiday as mills shifted to lower-cost Fe units. Steel margins have rebounded in May, but mills still have appetite for lower-Fe ores to fill the gap caused by disruptions to Brazilian ore supply.

Australian iron ore producer Fortescue Metals has narrowed the monthly contract discounts for its major fines products three times since March, and some discounts are set to narrow further in June.

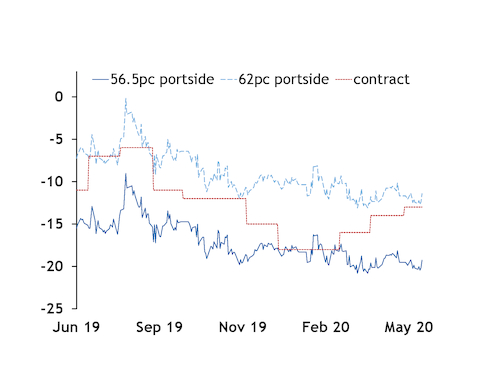

June-loading 56.5pc super-special fines (SSF) cargoes will be priced at a 13pc discount to the 62pc reference index, unchanged from May, Chinese market participants said. The discount has fallen from 18pc in January-February, 16pc in March, and 14pc in April.

The June discount for 58.3pc Fe Fortescue blended fines (FBF) will narrow to 7pc from 9pc in May. The discount has fallen from 12pc in January-February, 11pc in March, and 10pc in April.

The June discount for 61.2pc Fe West Pilbara Fines (WPF) will narrow to 1.5pc from 2pc. WPF's discount has narrowed steadily from 5pc in January-February.

Australian producer Roy Hill reduced its May fines discount to 2pc below the 62pc index from 3pc in April and 4pc in March.

The effect of wider profit margins and tight supply is seen in portside trade, where FBF has widened its premium to SSF to 80 yuan/wet metric tonne ($11/wmt) without deterring buyers. Earlier this year, mills would switch from FBF to lower-Fe SSF when the price gap exceeded Yn35/wmt, but that sensitivity has gone now that profit margins have strengthened, a Beijing-based trader said.

The Argus SSF Qingdao assessment rose by Yn9/wmt to Yn595/wmt today, a 19pc discount to the Argus PCX 62pc portside index at Yn737/wmt. On a 62pc Fe basis, the SSF portside price is 11.4pc below the PCX at Yn652/wmt.

The mining companies' contract prices are 62pc Fe basis differentials to the 62pc index.