Qatar will not reduce LNG loadings at the country's 77mn t/yr Ras Laffan terminal, despite global gas prices hitting all-time lows amid a drop in demand because of the Covid-19 outbreak.

Qatar will "absolutely no way" cut production from its liquefaction terminals, Qatar's QP chief executive Saad al-Kaabi said, even when coronavirus has exacerbated already weak global gas demand and pushed prices to record lows. It will take 1-2 years for demand to go back to pre-pandemic levels and for the industry to return to "some kind of normal", he said.

Qatar's low production costs, which allow it to be the "most efficient" LNG producer, leaves the country better placed than other producers and "very low in the pecking order" to shut-in LNG output, al-Kaabi said. Qatar has focused on limiting capital expenditure and operational expenditure to ensure Qatari LNG remains competitive even in an environment of low global gas prices, al-Kaabi said last year.

But Qatar could see a reduction in the price of its term contracts, which are indexed to oil prices. This is the "only risk [they] are taking", said al-Kaabi. Sharp falls in oil prices earlier this year could impact the country's oil-linked supply later on this year, depending on the indexation period.

LNG output to grow further

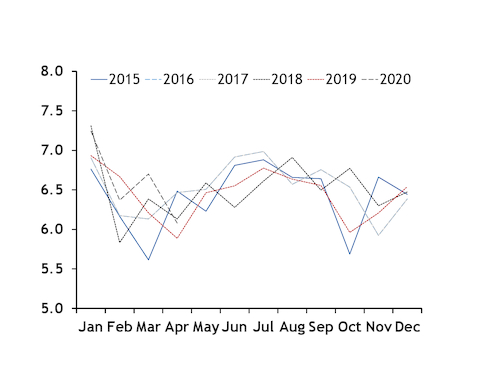

Qatari loadings have broadly held steady in recent years (see graph) and the country plans to boost its liquefaction capacity to 110mn t/yr by 2025. It was previously expected to complete the expansion by 2024.

QP plans on adding four trains with combined capacity of 32mn t/yr at Ras Laffan, exporting gas from the country's North Field expansion project, which started development drilling for the first phase last month. Qatar had initially planned to expand production capacity to 100mn t/yr by 2024 through adding three more 7.8mn t/yr liquefaction trains. But a fourth train of a similar size was later added to the plan after positive well results and favourable economic studies supported further liquefaction growth.

The firm has received technical bids for the main contractor, al-Kaabi said, but the deadline for commercial bids was rescheduled for September-October after bidders requested a delay. Qatar is "on schedule" to receive bids before end of this year, al-Kaabi said. Total, Shell and ExxonMobil were named as companies invited to join the project last year.

But the firm could still decide to implement the expansion plan on its own, if no agreement is made on a joint partnership — Qatar's new projects will produce LNG by 2024 "with partners or without", al-Kaabi said last year.

There are also plans to expand capacity further to 126mn t/yr by 2027, which were moving "full-steam ahead", with further capacity additions on top of that in the coming years not ruled out, al-Kaabi said.