Northwest European LNG sendout fell sharply early this month, led by a drop in regasification at French terminals.

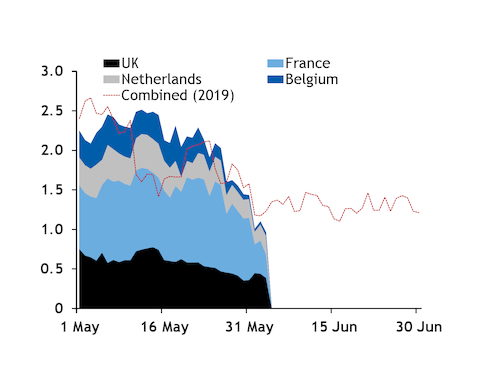

Combined sendout from the UK, France, the Netherlands and Belgium fell late last month from earlier in May before sliding further in recent days. It was 1.02 TWh/d on 1-3 June, well below the 1.68 TWh/d in the last week of May and 2.27 TWh/d earlier in the month.

French sendout fell sharply, dropping to just 358 GWh/d from 886 GWh/d on 25-31 May. Dutch and Belgian sendout also fell by a combined 126 GWh/d. Sendout from the UK was broadly unchanged, only slipping by about 6 GWh/d (see northwest European sendout graph).

Lower Atlantic-basin cargo availability may have encouraged preservation of stocks at northwest European terminals, especially with prompt prices at hubs holding wide discounts to contracts for delivery later in the summer.

Some 25-30 cargoes have been reportedly cancelled by term buyers from US terminals for loading this month. Feedgas supply to the US' six operational LNG terminals dropped in the first two days of June. And the early reopening of the Northern Sea Route last month, which had only started to be used in late June or July in recent years, may have also contributed to a drop in available cargoes. Northeast Asian cooling demand typically climbs in June from earlier in the summer, leaving less supply available for Europe.

And Norway's 4.2mn t/yr Hammerfest liquefaction plant has been off line since mid-May for maintenance, although the expected restart has been brought forward to 18 June from 30 June. The earlier restart could allow for at least two additional cargoes to be produced, which may head to European terminals.

Sendout from France's regulated terminals is expected to remain weak in the coming days. And regasification at these terminals could be slower this month and in July than earlier this summer, although it may still be well above recent-year averages.

But there could be some scope for Dutch sendout to step up in the coming days. Three cargoes are expected to arrive at the 8.7mn t/yr Gate terminal in the next few days, which could require regasification to accelerate. But no further cargoes have been scheduled for later in the month, and more deliveries would probably be needed to sustain quicker sendout into the second half of June.

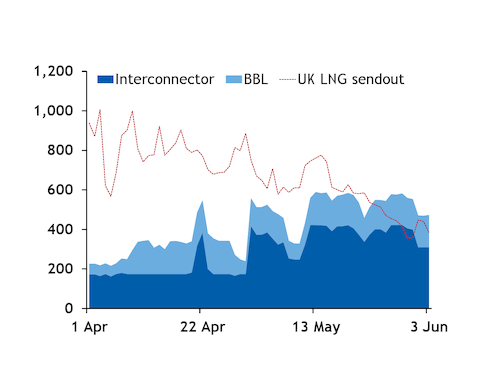

Deliveries to the UK could also slow this month, with lower LNG availability in the region. And slower receipts could leave less gas available for exports to the continent. Deliveries through the BBL have remained quick so far this month, but Interconnector flows have slowed, even with UK receipts largely unchanged (see BBL, Interconnector graph).

But South Hook could continue to receive Qatari supply throughout the month, following brisk deliveries to the terminal from Ras Laffan in May. South Hook has an agreement with state-controlled Qatargas to take cargoes when a more profitable destination cannot be found. And the Qatari supplier said there is "absolutely no way" it will slow operations even amid low worldwide LNG demand.

But even less LNG could be available for delivery to Europe in the following months.

Turndowns for July-loading cargoes from the US were widely reported to be greater than those for June loadings.

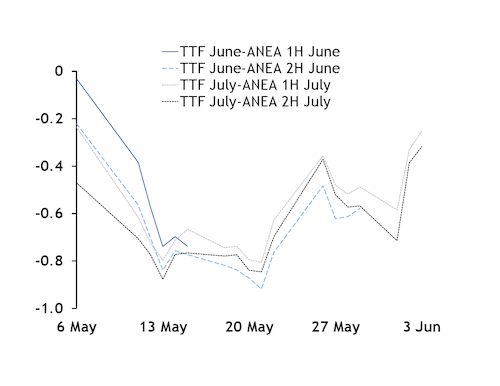

But TTF and NBP near-curve contracts have climbed sharply in recent days. The TTF June contract had already narrowed its discount to the Argus northeast Asian des (ANEA) prices for delivery in the second half of June at the contract's close on 29 May. And the July contract has narrowed its discount to the ANEA price for both halves of July further since then (see TTF-ANEA basis market graph). This could draw some cargoes to Europe and away from northeast Asia.

And even if LNG sendout remains slow, pipeline deliveries from other suppliers could step up to offset a decline in LNG deliveries.

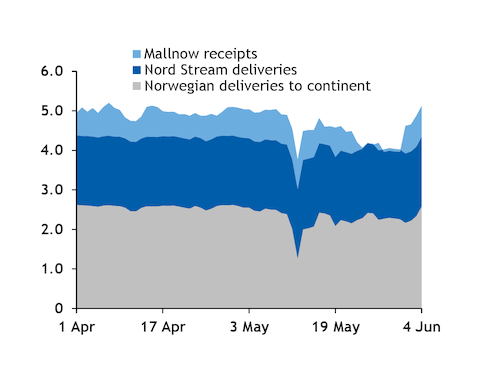

Norwegian pipeline deliveries to Europe, excluding the UK, also slowed earlier this month, sliding to 207mn m³/d on 1-2 June from 218mn m³/d in the last week of May. But deliveries have picked up since then, rising to 221mn m³ on 3 June and were on pace to reach 245mn m³ today.

Russian receipts stepped up at the start of the month, driven by quicker deliveries to Mallnow. And flows could remain quick over the rest of the summer. Russian state-controlled Gazprom booked June and third-quarter 2020 capacity along Yamal-Europe and could therefore consider the costs sunk again — which could incentivise quick sales through its subsidiaries and its on line platform even if prompt prices slide further this month, in contrast to late May (see Norwegian and Russian flows graph).