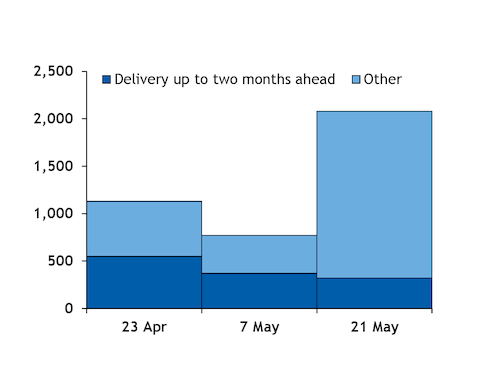

Russian state-controlled Gazprom's sales through its online platform surged in the past two weeks, with the majority sold for delivery in the third quarter of 2020 and little on a day-ahead or within-month basis.

The firm sold 2.08bn m³ on 21 May-3 June for a range of delivery periods, well up from the 771.6mn m³ on 7-20 May and 1.13bn m³ in the previous two weeks (see sales graph).

A total of 1.59bn m³ of sales over the past fortnight was for delivery in the third quarter. Gazprom had only sold 1.04bn m³ for July-September delivery prior to 21 May. That said, it had previously sold a further 1.85bn m³ for delivery over the whole summer.

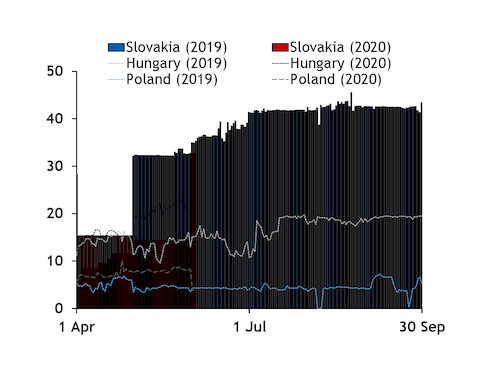

The highest portion of third-quarter sales on 21 May-3 June were for delivery to the Slovakia VTP, from where supply could be shipped on to Ukraine. Deliveries to Ukraine from Slovakia surged at the start of this month, and capacity bookings suggest they may remain brisk for the rest of summer (see Ukraine imports graph). Slovak gas transmission system operator Eustream listed some interruptible capacity at Budince available for booking for the rest of the summer this afternoon. But traders suggested all capacity at the point had been booked until October. Backhaul capacity at the adjacent Velke Kapusany was unattractive, they said.

Consumption in Slovakia has remained muted, and injection demand at the country's storage sites is weak this summer, suggesting that a substantial share of the supply delivered to the Slovak VTP in the third quarter could be exported.

Gazprom may have stopped offering supply for day-ahead and within-month delivery through the platform. The last sales on a within-day, day-ahead or balance-of-month were made on 21 May. Gazprom last published daily product offerings on 25 March, but traders suggested there were no day-ahead and within-month offerings in recent weeks.

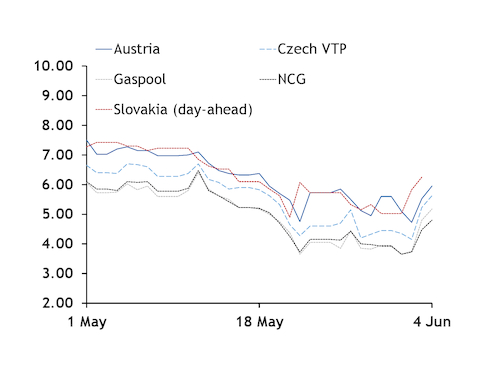

Some also suggested that it may have been unprofitable for Gazprom to offer gas on this basis, following the plunge in European prompt prices towards the end of last month (see prompt prices graph).

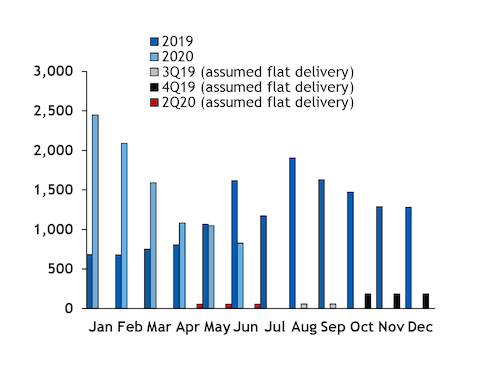

Aggregate sales made on the platform for May may have been lower than a year earlier. This would be the first year-on-year decrease since the platform was launched in September 2018. And sales could remain weaker on the year, as online platform sales jumped last June compared with May 2019. By contrast, they have fallen on a month-on-month basis so far this year (see year-on-year sales graph).

Sales price slides through May

The most recent sales update suggests that the price of gas sold on 21 May for within-day, day-ahead, weekend and within-month delivery fell compared with earlier in the month.

Sales were made for these delivery periods to Germany's Gaspool and NCG market areas and the Slovakia VTP as well as to the Olbernhau and Baumgarten delivery points.

The gas sold for an average volume-weighted price of about €5.21/MWh ($58/'000m³), based on the difference between the May price in €/MWh reported for sales made up to 20 May and the final price for May, assuming that all sales made are included in the sales price at time of publication, irrespective of whether they have been delivered or not.

Gazprom publishes a volume-weighted sales price for all deliveries made during current and completed months, which it updates when publishing its most recent sales data.

And the weighted average price may have been around €5.78/MWh ($65/'000m³) for within-day, day-ahead and weekend sales over the previous fortnight, when there had been sales for delivery to Gaspool, the NCG, Austria VTP and Slovakia VTP as well as Olbernhau and Baumgarten.

Gazprom is liable for a 30pc customs duty on its export sales, as well as mineral extraction tax (MET), which is assessed at different rates depending on the production location, under Russian regulation. It could consider its transport costs as sunk, given that it operates the Russian pipeline system and has a number of long-term bookings in Europe where it delivers gas sold on the online platform.