The current terms lack economic incentives and will not rekindle auction interest following two underwhelming sales late last year, writes Nathan Walters

Brazil will need to abandon production-sharing contract (PSC) terms for pre-salt acreage in favour of a concession model if it is to sustain offshore investment in the post-pandemic landscape, oil industry executives say.

Brazil's oil producers have been pushing for an end to the PSC for years, but executives from firms including state-controlled Petrobras, Shell, Norway's state-controlled Equinor, BP, Total and Chevron say the move to a unified concession model is now necessary to attract the industry's whittled-down investment capital. Adopted in 2010, Brazil's PSCs award acreage within the so-called pre-salt polygon to whichever bidder offers to share the highest percentage of profit oil — total production minus costs — with the federal government, which is represented in consortiums by state-owned marketing firm PPSA. The latter audits costs and has the power to veto development plans, but holds no equity.

Petrobras chief executive Roberto Castello Branco says Brazil's prolific geology is no longer enough to entice investors. "The sharing regime is very disadvantageous from an economic point of view," he says. "It gives companies the wrong stimulus — instead of maximising efficiency the aim is to inflate costs to reduce taxation on profit." And PPSA's role of effectively determining return on capital is a disincentive for investors, Castello Branco says.

Shell is the country's second-largest producer after Petrobras, and its Brazil president, Andre Araujo, says Brasilia has to make changes to attract firms back to upstream auctions, including improving exploration-phase conditions for blocks awarded in recent licensing rounds. "A change in regimes doesn't necessarily mean a return of investments. Concession contracts also have to be attractive," he says.

Regulatory complexity and costs alienated Shell and its peers from participating in two pre-salt auctions in November 2019, ending a successful two-year run that had reanimated foreign investment in Brazil after the 2014-16 oil price collapse. The country has suspended a concession model round and pre-salt offer planned for this year because ofthe Covid-19 fallout, but still plans a June 2021 auction of two areas not awarded in last year's pre-salt transfer-of-rights auction.

The government has prioritised a bill that would allow some areas in the pre-salt polygon to be offered under the concession model contract. But progress on the proposal has stalled as the country deals with Covid-19 and several scandals that have shaken the conservative presidency of Jair Bolsonaro, who has given broad authority to his pro-market economy minister Paulo Guedes.

Mines and energy minister Bento Albuquerque recently spoke in favour of a simplified contract model, but the factious congress has shown little interest in accelerating the change, partly because of implications for political support and local tax revenue. PSC revenue was originally meant to fund Brazilian education.

Espirito is willing…

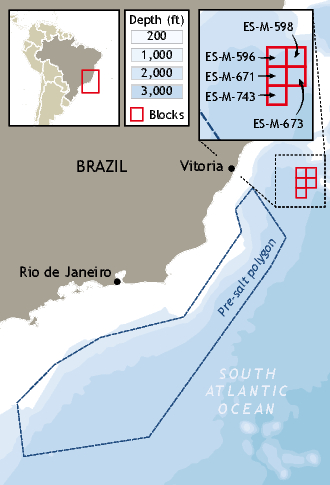

Upstream investor appetite in the Espirito Santo basin exploration frontier will be gauged this month as Petrobras aims to divest working interests in five deepwater blocks — the latest assets on offer in the firm's $20bn-30bn divestment plan (see map). Total and Equinor are assigning their stakes in the blocks to Petrobras. Once oil regulator ANP approves this, Petrobras will hold 100pc stakes in ES-M-596_R11, ES-M-671_R11 and ES-M-743_R11, and 80pc working interests in ES-M-598_R11 and ES-M-673_R11 — both operated by Brazilian independent Enauta.

Petrobras will divest up to 50pc of the wholly owned assets and up to half of its 80pc stakes. It says the blocks have the potential to be significant pre and post-salt resources. Qualified companies have until 10 June to express interest, testing Petrobras' claim that Covid-19 has not diminished appetite for its upstream assets.