The amount of gasoline being held in floating storage in northwest Europe is falling, easing oversupply concerns for exporters and regional producers.

Just under 600,000t of gasoline is floating offshore northwest Europe, according to Argus analysis and data from oil analytics firm Vortexa. This is down from more than 1mnt at the end of May, and closer to levels of a month ago.

Only 60,000t is unfinished grade or blending components, compared with around 275,000t of at the end of May, suggesting that blending demand has increased in Europe and in export markets such as the US as strict travel restrictions are wound down.

Gasoline in floating storage in the Mediterranean is now just under 140,000t, from 190,000t at the end of May and a peak of around 325,000t in the middle of last month.

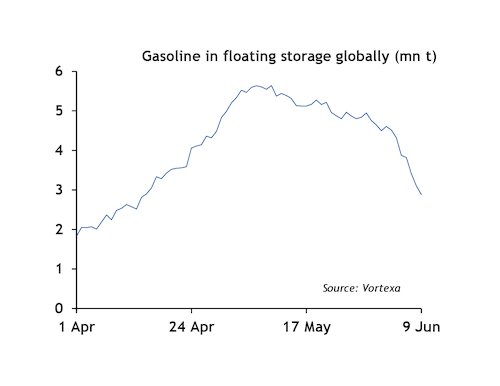

Northwest Europe has caught up with a global trend. Levels of gasoline in floating storage globally reached a peak of around 5.6mn t in the first week of May, but have fallen steadily to below 3mn t as of today. This is similar to levels last seen in the middle of April, but is still well above the global average of under 1mn t last year.

Higher outright gasoline prices are prompting exporters and producers to draw on stocks that were placed into storage at much lower levels. Benchmark Eurobob oxy gasoline reached a three-month high of $354.50/t yesterday, up from below $300/t just a week earlier. Gasoline barges in northwest Europe reached an all-time low of $103.50/t on 22 April, and were trading below $200/t as recently as a month ago.

Refining margins have also improved. Eurobob oxy gasoline's notional margin to Ice Brent moved back to a premium yesterday for the first time in three weeks. Gasoline barges were at a $1.31/bl premium to Ice August Brent as of yesterday's close, also a three month high.