Russian gas deliveries to Europe, excluding the Baltic states and Turkey, have risen this month from May.

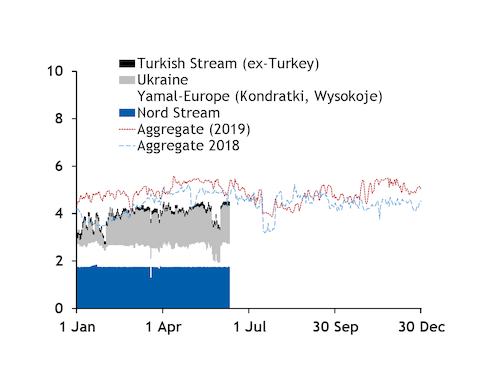

Deliveries to Europe at the Nord Stream link's German exit point in Greifswald, the Polish entry points of Kondratki and Wysokoje, all Ukrainian exit points and the Strandzha-2 point between Bulgaria and Turkey averaged 4.47 TWh/d on 1-10 June, up from 4.12 TWh/d in all of May (see Europe flows graph).

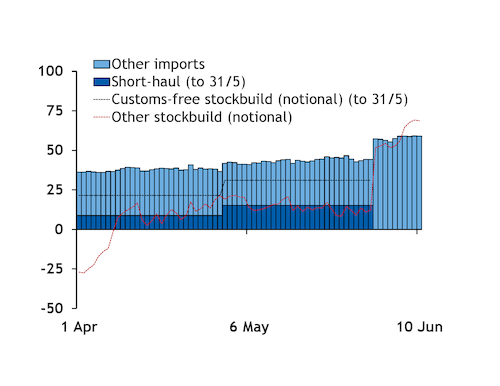

Some flows to Europe from Ukraine may have been Ukrainian exports or deliveries made under the country's short-haul programme, rather than having been sent from Russia. But Ukraine's state-owned gas transmission system operator GTSOU said earlier this month that "almost all" short-haul deliveries last month were sent to Ukrainian storage facilities (see Ukraine imports graph).

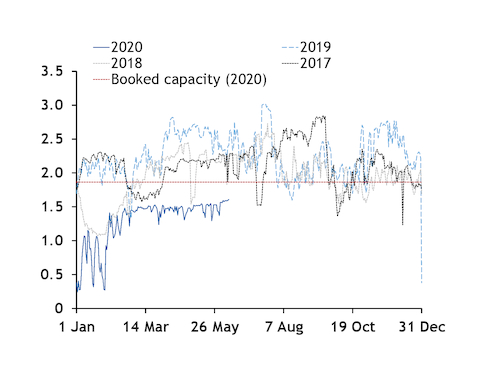

Flows were boosted by much stronger deliveries through Poland along the Yamal-Europe route at the start of the month, after these had fallen sharply at the end of May and even halted at times. But flows through Ukraine also climbed and were on course to be their highest for any month this year, averaging 1.58 TWh/d on 1-10 June, up from 1.48 TWh/d in May (see Ukraine flows graph).

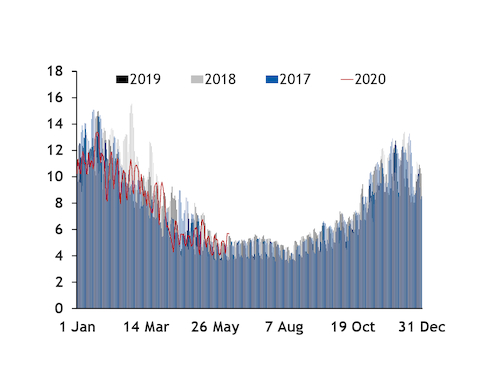

European demand, including in some markets to which Gazprom typically makes quick sales, was supported at the start of this month by unseasonably cool weather after it had slumped sharply earlier in summer from previous years because of Covid-19. But demand in seven of the largest markets — which made up 64pc of sales in the second quarter of 2019 — was still down from May. Combined consumption in Germany, Italy, France, the Netherlands, Austria, the Czech Republic and Poland fell to 5 TWh/d on 1-10 June from 5.2 TWh/d in May (see demand graph). And the stockbuild in these markets also fell — to 2.4 TWh/d from 3 TWh/d.

But a sharp drop in northwest European LNG sendout bolstered the region's need for supply from other sources. LNG sendout had been brisk earlier in the summer, but European receipts typically slow as cooling demand elsewhere rises. And the halt of Norway's Hammerfest export plant and US cargo cancellations may have curbed European LNG availability.

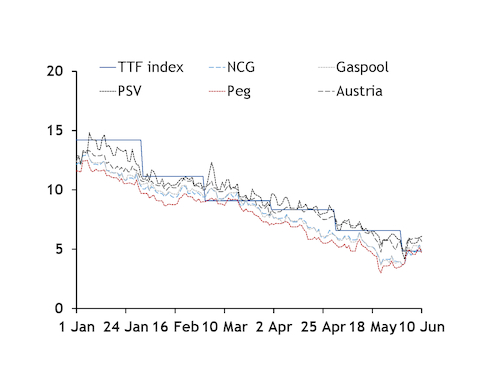

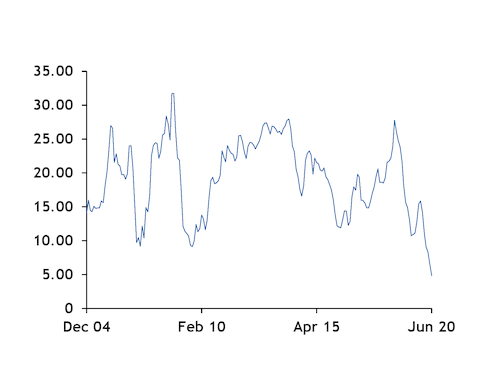

Weaker LNG sendout and unseasonably cool weather provided some support to European prompt prices earlier this month. Prompt prices across much of the region largely held above the TTF front-month index's settlement for June of €4.842/MWh, which was the lowest for any month since at least December 2004 (see settlement price graph). This may have provided an incentive for imports under long-term contracts linked to the index. Prompt prices holding above the front-month index's settlement contrasts with most days earlier this year (see TTF v prompt graph).

Quick Russian deliveries to Europe at the beginning of this month may have also supported quick EU exports to Ukraine. These climbed to 605.6 GWh/d on 1-10 June from 454.6 GWh/d in May.

Some Russian pipeline deliveries may also be for injection into Gazprom's own storage space, although this could make up a smaller share than in previous summers as the firm probably began April with much higher inventories. The company said it had 11.7bn m³ of gas in European sites at the end of 2019. And overall Russian pipeline deliveries totalled 356.8TWh, or about 34.7bn m³, in the first quarter. This was not far off first-quarter sales to Europe, excluding the Baltic states and Turkey, of 36bn m³, and may indicate that substantial inventories were carried into summer. This could limit Gazprom's injection demand, unless it has further expanded storage bookings.

The scope for Russian sales into Europe for the rest of 2020 may partly depend on the extent and speed of demand recovery in the wake of Covid-19, as well as supply from other sources, including LNG.

Weak consumption, high stocks and strong LNG sendout may at times this summer have resulted in prompt prices at some European hubs falling to, or close to, levels at which sales might no longer be profitable for Gazprom.

The Russian firm previously reported average production and domestic mineral extract tax (MET) costs of around Rbs185/MWh. Based on current exchange rates, and adding the 30pc duty the firm pays on exports, this would put its breakeven price — assuming its transport costs are considered sunk — at €2.70-3.00/MWh ($34/'000m³).

And the firm appeared not to have sold any supply for prompt delivery through its electronic platform in late May-early June.

Sales of gas for prompt delivery through the platform were most recently reported for 21 May. Supply was then sold into different markets and delivery periods for a weighted-average price of €5.21/MWh ($58/'000m³).