South Korea-delivered coal prices fell this week, although a surge in weather-driven power demand is likely to be supporting short-term consumption among utilities.

Argus assessed NAR 5,800 kcal/kg coal delivered to South Korean ports $1.23/t lower on the week at $55.87/t, which equates to $58.57/t on a NAR 6,080 kcal/kg basis. The fob Newcastle NAR 5,800 kcal/kg price, which is sensitive to South Korean fundamentals, fell by $1.39/t to $46.36/t.

State-owned Korea South-East Power was understood to have awarded a minimum NAR 5,600 kcal/kg baby Capesize cargo of Australian coal to producer Glencore for loading in the first half of August from Abbot Point at around $50/t on a NAR 6,080 kcal/kg basis.

The same utility also awarded two Panamax cargoes of Russian coal to a major producer at around $55/t fob for September and October loading, sources said.

There were no changes to the short-term coal plant maintenance schedule in South Korea this week, with available state-operated capacity still up on the year. Some 28.2GW is currently expected to be available for the month of June, which would be up from 26.2GW a year ago.

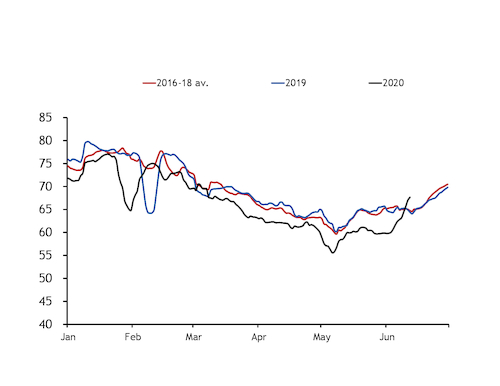

And hot conditions in northeast Asia are likely supporting plant running hours, as peak power demand for cooling has spiked in recent days. Peak daily demand reached as high as 75.3GW this week and averaged 67.6GW over the past seven days, which is above the 64.2GW 2015-19 seasonal average.

Temperatures in Seoul were 3-4°C higher than the 10-year average this week and there is a 40pc chance of unseasonably warm conditions for the rest of the month, according to the South Korean meteorological administration.

Coal continues to compete strongly with oil-linked LNG on price within the South Korean base load, which means the fuel should be the first recourse for utilities as electricity demand climbs.

Generation data for April published today show coal's share of total fossil fuel-based generation in South Korea recovered to 60pc in April, from 52pc over December-March and 55pc in April last year. The increase is the result of fewer plant restrictions and reflects the fuel's continued cost advantage over natural gas.

But weak power demand because of Covid-19 measures pressured aggregate fossil fuel consumption on the year in April and slowed the rise in outright coal burn, despite its greater share of the mix. National power generation sank by 3.7pc on the year in April to 58.8GW, a three-year low for the month of April. Kepco's sales to the industrial sector fell by 6pc on the year to 31.4GW.

The same trend may have unfolded in May, with weaker South Korean coal imports hinting at only modest consumption and ample stocks.