Exports of ferrous scrap from the UK dipped by 7.8pc on the year in April as Covid-19 lockdowns had a mixed impact on overseas demand.

The UK exported 635,721t of ferrous scrap in April, down from 689,392t in the same month last year, customs figures show. The fall in overall shipments was driven by a drop in demand in most of the UK's key overseas markets following strict containment measures imposed to tackle the spread of Covid-19, combined with a collapse in containerised shipments caused by a global lack of container availability.

Shipments to south Asia were hardest hit, in part because of country-wide lockdowns that disrupted demand and industrial activity and also because countries there are major consumers of containerised scrap. India was subject to one of the most severe lockdowns of any country, with ports at a virtual standstill and material stuck for long periods of time. And April was when the wider global shortage of containers caused by the backlog built up in China throughout January-March severely disrupted UK exporters' ability to source boxes for shipment. Additionally, the shortage caused container freight rates to rise so sharply that shipping on a cfr basis to south Asia became temporarily unviable for many suppliers.

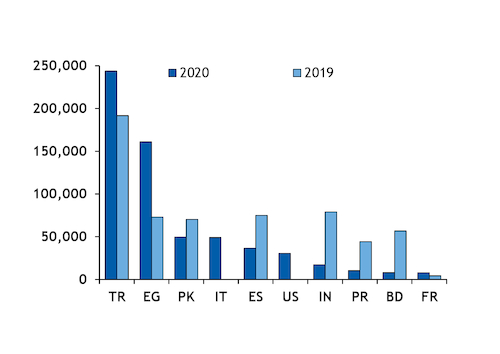

UK ferrous scrap exports to India and Bangladesh fell by 78.4pc and 85.9pc on the year to 17,062t and 7,992t. Shipments to Pakistan dropped by 29.4pc to 49,657t.

The drop-off in container sales caused scrap to be diverted into the bulk export market, where the mainstay markets of Turkey and Egypt still maintained considerable demand even into April. Ferrous scrap exports to Turkey — the UK's single largest market — saw a large rise in shipments. UK-based exporters shipped 243,777t to Turkey, a 27.1pc increase on the year.

Exports to Egypt, another key overseas market, rose by 120.6pc to 160,998t. Exports to the rest of the UK's top 10 overseas markets in April were mixed (see graph).

Argus deep-sea vessel tracking data show a significant fall in exports in late April and May. A lack of overseas demand and domestic scrap generation led to a period where no deep-sea bulk shipments were shipped from UK docks between 19 April and 18 May.

Overall, April was only partially impacted by the UK's lockdown, which began on 23 March, as scrap reserves likely offset dwindling scrap flows. Following the lockdown, scrap flows started to diminish as major recyclers in the country imposed strict measures to limit purchases from third parties, while some shut many yards.

May exports are likely to significantly weaker on the year as reserves dwindled, flows dried up and overall global scrap demand was weaker.