WTI Cushing's plunge into negative territory in April has led many participants to look for an alternative marker

US crude trade has been marching to the sea for years. But it has always retained a tether to the inland pipeline nexus and tank farm at Cushing, against which deals are priced. Ties to Cushing have been a boon in some respects. They allow buyers and sellers access to the largest pool of hedging liquidity in the oil market, Nymex WTI futures. But Cushing is also plagued by restricted delivery options and infrastructure limits that are disrupting coastal markets, and the industry is seeking a solution. Thriving US crude export trade and the Gulf coast refining sector need an outright reference price not hostage to the constraints of Cushing.

Crude markets have been awash with discussion about benchmarking since Nymex WTI futures settled at a negative price for the first time on 20 April. Large Opec and Latin American producers were dismayed to "discover" that the spot markets against which they benchmark their crude shipments to the US are tied to the Nymex WTI futures contract through differentials. These differentials failed to adjust for the downward spike in prices fast enough to prevent those spot benchmarks from also going negative on 20 April.

Large US producers and refiners have also been examining market mechanisms that might prevent a recurrence. These include switching into second-month futures contracts earlier, and using the Nymex CMA price — a whole-month average for the month of delivery — and Argus' WTI differential to the CMA as the basis for physical trades. Some firms may adopt the latter mechanism. But thinking is also crystallising around a genuine outright price for Midland-quality WTI at the Gulf coast to build a more robust market distinct from Cushing WTI.

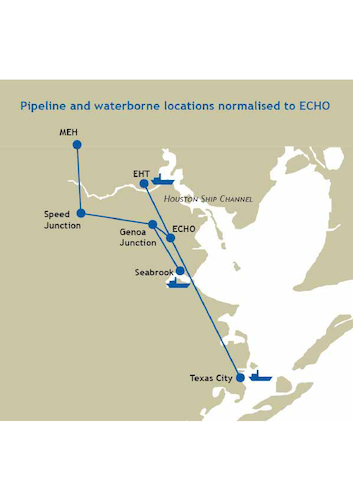

As a result, Argus and its competitor Platts launched new price assessments on 26 June to reflect activity in the AGS (American GulfCoast Select) market. The methodologies differ somewhat. Argus is launching two indexes — one an outright price and one a differential to WTI futures — that incorporate the liquidity of both the waterborne cargo and pipeline crude markets at seven locations along the Gulf coast (see map). Platts' assessment omits the more liquid Gulf coast pipeline market and has a forward delivery timeframe arguably better suited to European markets than to the US market's prompter pipeline cycles.

Leading market participants are already hoping that fixed prices will predominate, eventually opening the way to new Gulf coast hedging instruments that avoid the Cushing trap. Cushing's problems are well documented. The market was originally established as a gathering and blending point for US and imported crude to go to refineries in the midcontinent. But the rise of shale and infrastructure limits make the hub vulnerable to price spikes or dips. Mideast Gulf producers switched to Argus ASCI a decade ago precisely because of such market anomalies.

The move to establish a new outright Gulf coast price marker will challenge decades of habit. Key industry supporters of the initiative have one eye on the mounting weaknesses of the Brent complex. The benchmark for much of the world's non-Americas crude has a long-term liquidity problem because it is based on waning output of suitable North Sea fields. But US crude exports remain around 3mn b/d, despite the slump in domestic output, and the Houston area has 4.4mn b/d of refining capacity. With such a large pool of liquidity, it is only natural for the Gulf coast market to gravitate to a more inclusive benchmark.