Germany's road fuel demand is edging up towards normal as the country adjusts to light-touch measures to tackle Covid-19 after a period of lockdown. But refineries face unusually high stocks across the country, which are keeping prices down.

Many participants in the inland wholesale market have notified suppliers that they wish to take their entire term volumes for diesel and gasoline in July. This underscores their expectation that consumer demand will be mostly back to normal soon, although they expect to top up less on the spot market than in a normal year. They had cut their term volume deliveries by 30-40pc in May, and then in June by around 10pc from agreed volumes for diesel and by 20-50pc for gasoline.

Anecdotal evidence from retail stations and market participants puts demand for gasoline and diesel at around 85-90pc of normal levels, compared with around 80pc in some parts of May and 60pc in April for both fuels combined. The increase reflects ramped up industrial and logistical activity, and increased road traffic especially as domestic driving is replacing international air travel this summer holiday season.

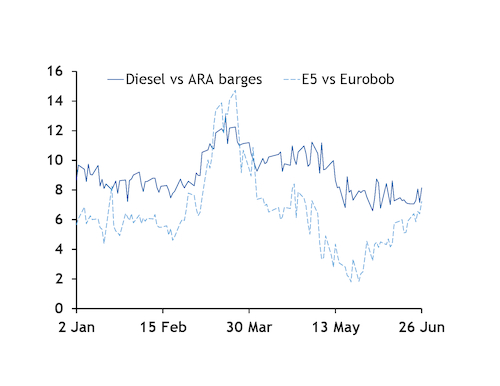

Refiners started ramping up runs from around 70pc in April at the first sign of stronger demand, which pushed stocks to their limit and compressed premiums to prices in the Amsterdam-Rotterdam-Antwerp (ARA) hub. Diesel fell to just €7.75/100l ($102.32/t) above ARA barge prices on average from mid-May to mid-June, from €10.50/100l in March and April. Most of the current premium covers the costs of the greenhouse gas (GHG) reduction quota and is even lower than the €8.50/100l seen in January-February before any lockdown measures.

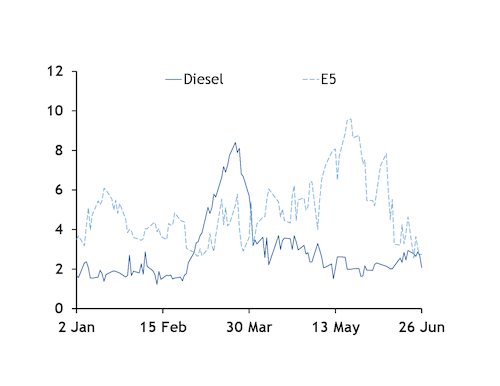

In a sign of abundant supply across Germany, diesel prices in all locations have converged. The difference between diesel in the most expensive and cheapest regions shrank to just over €2/100l yesterday, not far above the average €1.80/100l difference in January-February.

Domestic gasoline prices have also converged, reflecting plentiful supply across the country and large stocks. Regional differences inside Germany tend to be larger than for diesel because the country is structurally long gasoline, so prices at refinery locations can be far lower than at import hubs.

German E5 prices have recovered to a premium of above €6/100l to Eurobob barges on average since mid-June, indicating that demand has caught up with an early rise in production. The premium covers the GHG quota costs and can give a profit margin to suppliers with access to cheap biofuels. The premium to ARA was below €3/100l at times in late May, when refineries started increasing runs. As this did not cover the cost of blending ethanol, it effectively priced the non-blended product below Eurobob for export, pointing to an overhang and a lack of storage capacity. Official data released yesterday for April put the year-on-year fall in inland deliveries of gasoline at just 34.5pc. The drop is far smaller than reported at many retail stations and is likely to include product still in storage.