The Netherlands has turned into a net power exporter this month, with total net flows on track to reach their highest-ever level, amid an increase in day-ahead flows to Germany.

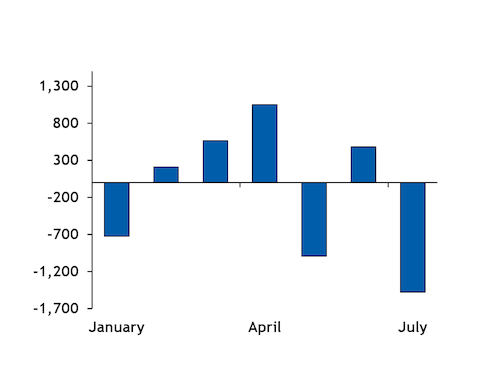

Dutch overall net exports averaged 1.46GW from 1-15 July, the highest level for any month. By comparison, the Netherlands was a net importer, at an average of 482MW in June.

The Dutch market was a net exporter to its borders for the first time in October last year, and it has been a net exporter in five months since then.

Power exports to Germany saw the sharpest increase on the month. Dutch net day-ahead flows to Germany have averaged 570MW so far in July. This was up from net imports averaging 10MW in June.

The German day-ahead base load on the Epex Spot averaged €30.20/MWh for delivery on 1-16 July and moved at a discount of €0.13/MWh to the equivalent Dutch settlement, from €0.15/MWh in June. The Dutch day-ahead traded at discount to the German market on 13 days so far this month.

Dutch spot prices remain under pressure amid lower TTF gas prices. Working day-ahead break-even costs for a 55pc-efficient gas-fired plant have averaged €19.61/MWh this month. This compares with €20.01/MWh average break-even costs for a German gas-fired plant with the same efficiency, based on NCG fuel costs.

Higher Dutch nuclear power plant availability, combined with higher wind levels at the beginning of this month, have also allowed more power to be freed up from the Netherlands into Germany.

Dutch nuclear output increased by 253MW on the month to 470MW, as the shutdown at the 485MW Borssele nuclear reactor ended in the first half of June. Total wind output has risen to 1.67GW, from 1.32GW in June.

In Germany, wind and solar power output has also been higher on the month. But nuclear power plant capacity is at 5.9-7.1GW given the shutdowns at the 1.3GW Neckarwestheim 2 reactor on 18 June-18 July and the shutdown at the 1.41 Isar 2 nuclear plant from 10 July-4 August, supporting demand for Dutch power from Germany.

Outlook

The Dutch week-ahead base-load contract closed at €31.60/MWh yesterday and at a €1.40/MWh discount to the German market, suggesting flows will continue higher in the direction towards Germany.

But weather forecasts suggest lower levels of wind output in the Netherlands, at 20-690MW from 15-21 July.

German nuclear power plant availability is expected to be at 7.14GW and wind levels are expected at load factors of 2-17pc during the same period.

Moving forward, the Dutch August base-load contract last traded yesterday at €31.50/MWh and at a discount of €1.25/MWh to the German market. The discount to the Belgian market was €0.90/MWh, while it is moving at a €3.81/MWh discount to the UK market and at a wide premium to the Nordics.