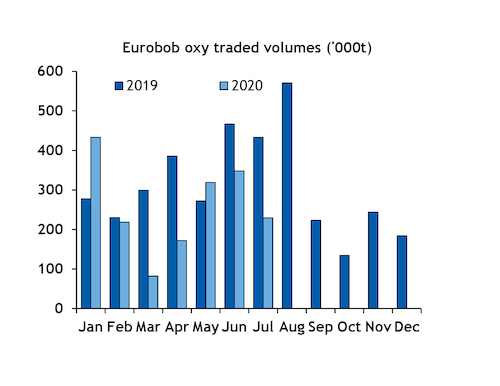

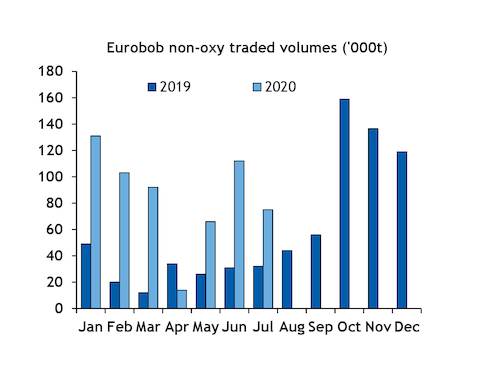

Argus Eurobob traded volumes slipped to a combined 304,500t in July, from 460,000t in June and 465,000t a year earlier, as the post-Covid rebound seen in May and June eased.

Oxy gasoline barge trading liquidity fell to 229,500t in July, from 348,000t in June and 433,000t a year earlier. The total for the first seven months of the year was 1.80mn t, compared with 2.37mn t in the same period of 2019, more in line with the 1.9mn t traded in the first seven months of 2018.

Total was the largest buyer in July, securing 122,000t after making no purchases in June. Shell bought 43,500t, also compared with nothing in June. Trading firm Vitol bought 26,000t, after 134,000t a month earlier. The remainder was purchased by BMV Mineral, BB Energy, BP, ExxonMobil, Gunvor, Hartree, Litasco, Macquarie, Trafigura and Varo.

Gunvor was the largest seller with 91,500t in July, compared with 19,000t in June. Hartree sold 74,000t, compared with 50,000t the previous month. BP sold 24,000t and Petroineos 26,000t in July, compared with 11,000t and 4,000t, respectively, in June. Finco, Litasco, Macquarie and Neste sold the remainder.

Trading liquidity on Argus Eurobob non-oxy gasoline barges fell to 75,000t in July, from 112,00t in June and compared with 32,000t a year earlier. Non-oxy barge volumes are higher at 462,000t for the January-July period, compared with 155,000t in the same period last year.

Varo was again the largest buyer, with 63,000t, after it bought 82,000t in June. ExxonMobil, Gunvor and Van Raak purchased the remainder. US-based refiner Phillips66 sold 36,000t in July, from nothing in June. BP, Finco, Glencore, Litasco, Shell and Total sold the remainder.