The London Metal Exchange's (LME) fob China hot-rolled coil (HRC) futures contract traded a record volume in July, driven by new participants and increased long positioning.

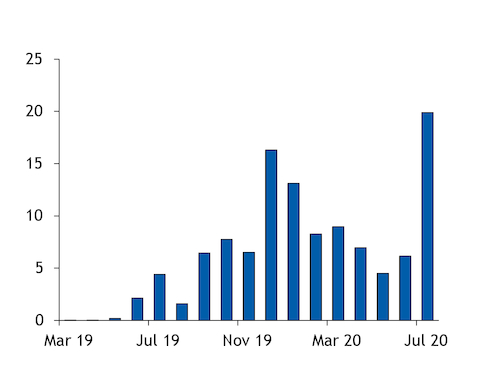

The contract traded 19,897 lots, or 198,970t, in July, up by 224pc from June and 830pc from a year earlier, surpassing the volume for the previous April-June quarter. July was 22pc higher than the previous high set in December 2019. The contract, which settles basis Argus' fob China index, cleared its first million tonnes of steel traded on 7 July since its March 2019 launch with a value in excess of $460mn.

"The contract appears to be gaining traction as brokers, traders, banks and funds gain increasing familiarity with it," a trader said. LME's marketing efforts working with banks in Vietnam has driven increased use of the contract by physical participants, he said.

"The entrance of new participants has lifted volumes on the LME HRC fob contract recently," a broker said. Another broker said the rising volume bode well for the contract and as a result his company is planning to start trading it soon.

The Argus fob China HRC index moved in a $44/t, or 10pc, range in July between a low of $438/t and high of $482/t at the end of the month. Global HRC and Asia ferrous markets were volatile in July as the focus remained on China's strength amid weakness in most other markets still facing a severe Covid-19 pandemic.

China is on pace to produce 1bn t of steel in 2020, with its steel markets skipping the typical late summer slowdown in steel output and demand because the peak construction season was pushed forward by early year Covid-19 lockdowns.

China's steel demand is so strong it has increased imports of finished and semi-finished steel to include coil this year, pushing up seaborne prices and leading some Indian mills to use the fob China HRC index as a reference when exporting coil to China, market participants said.

The Australian treasury's forecast in late July that ore prices will fall to $55/t fob Australia by December this year surprised many physical market participants, leading them to consider using more hedging tools amid the market uncertainty, especially in Asia, an international trading firm manager said.

The fob China index's wide discount to Chinese domestic prices at the start of July possibly attracted speculative buyers of the contract, the trader said, as did increased speculative interest across onshore steel and iron ore futures over the month.

Fast-rising HRC prices are persisting on the futures curve, which currently holds above $480/t through to the end of the year. The contracts for February 2021, August 2020 and December 2020 are the most active trading months with volumes at 23, 21 and 15 lots respectively, according to the LME yesterday.

This new record a similar record set on the CME for Argus-settled European HRC volumes.