The US oil and gas sector has spent years using digitalisation and engineering to get more out of the ground for less. This year's crude price crash has drastically sped up cost-cutting, as service firms and producers axe their costliest assets — staff.

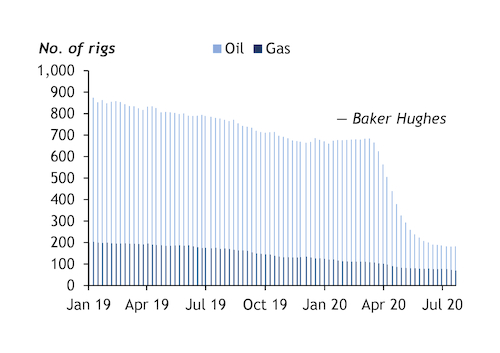

Oil and gas employment was already falling from its December 2018 high throughout 2019, as crude prices refused to stay above $65/bl. Production costs were also falling, as shown by record output with a declining rig count (see chart). But the Opec+ price war and the Covid-19 demand shock turned those declines into a stampede.

Production has been curtailed and rig crews sent home. In Texas, direct upstream oil and gas employment fell by 30pc between December 2018 and June 2020, or by more than 66,000 jobs, according to the Texas Alliance of Energy Producers. Over 40,000 of those cuts have come since February, with 25,000 in April alone — more than double the previous layoff record.

The charge was led by oil service companies, which traditionally serve as a buffer between producers and crude prices. Schlumberger's second-quarter charges included $1bn in employee severance payments, as it cut about 25pc of its global workforce, or 21,000 workers. Halliburton laid off 5,447 in Texas alone, according to state data, while dozens of smaller firms reduced their workforces. But the fate of BJ Services — a 148-year-old service firm focused on hydraulic fracturing — underlines the dire outlook for the US shale sector. The company could not even negotiate $75mn in new funding from an existing investor, and filed for bankruptcy last month with plans to sell off most of its assets.

Upstream producers are more circumspect about their job-cutting efforts than service firms, but heads have been rolling there too, through forced retirements and more aggressive performance review measures. But while service providers rang the bells of doom during their earnings calls — saying they expect the North American production recovery to be slower and longer than for any other region — the tone from the first wave of US upstream independents to report earnings is more optimistic.

ConocoPhillips, Hess and Apache say that nearly all of their previously curtailed production is back on line, with the prospect of profitability looming. Many companies expect production to be little changed compared with 2019, but plans to restart drilling completions — where a well is brought into production — are largely on hold until prices rise. "We don't envision returning rigs to the Permian basin unless oil prices recover well into the $50s/bl," Apache chief executive John Christmann says, echoing a comment from his Hess counterpart John Hess about Bakken shale operations.

Never say die

The different outlooks reflect the recovery in prices and signs of strengthening demand compared with March, when many companies were staring into the abyss, energy investment boutique Pickering Energy Partners' founder, Dan Pickering, says. "They've shifted from ‘we're gonna die' mode to figuring out how they are going to live in a $40/bl world," he says. And while the workforce has been cut in a hurry, future drilling and production will not require the same level of capital — human, financial or material — he predicts.

Concho Resources president Jack Harper sums up the story of 2020 for the shale sector: "When we came into this year, we described our business plan in the $50/bl environment and the things we could do," he says. "And as prices have bounced around and costs have changed, what could be done at $50/bl can now be done at a lower price."

| Oil service firms' results | $mn | ||

| 2Q20 | 2Q19 | ±% | |

| Profit | |||

| Schlumberger | -3,434 | 492 | na |

| Halliburton | -1,676 | 75 | na |

| Baker Hughes | -201 | -9 | na |

| Revenue | |||

| Schlumberger | 5,356 | 8,269 | -35 |

| Halliburton | 3,196 | 5,930 | -46 |

| Baker Hughes | 4,736 | 5,994 | -21 |

| North America revenue | |||

| Schlumberger | 1,183 | 2,801 | -58 |

| Halliburton | 1,049 | 3,327 | -68 |

| Baker Hughes | na | na | na |