Participants in Germany's NCG gas market area suggest that allowing smaller volume transactions in futures markets, as well as merging the market with neighbouring hubs, could lift liquidity.

The NCG's market area manager had asked for suggestions on lifting liquidity in its annual consultation in June, which aims to gauge customer satisfaction.

To lift liquidity in the NCG's futures and forwards markets, brokers should reduce the minimum traded volume to 1MW from 5MW for the NCG, similar to Germany's power market, market participants said.

And a merger with adjacent markets, including the Dutch TTF, would further lift liquidity, firms suggested.

Germany's NCG and Gaspool areas are planned to be merged from 1 October 2021 into a single German virtual trading point (VTP), Trading Hub Europe, ahead of a binding deadline of 1 April 2022. Some market participants have speculated that the merger of the two markets could spark a rise in liquidity, although others have expressed doubts that any gains would be significant, warning that a loss of liquidity could follow as trading opportunities between the two hubs disappear.

But consultation participants suggested that the upcoming merger should increase liquidity and encourage trading the spread between the NCG — or the unified German VTP — and the TTF, as well as the German market and Belgium's ZTP.

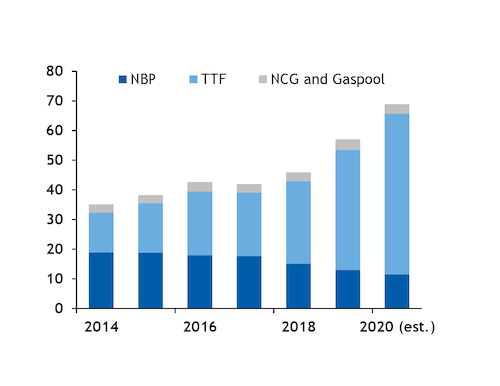

The TTF is by far Europe's most liquid hub, with traded volumes on exchanges and over-the-counter rising steadily in recent years. In contrast, liquidity at the German hubs has stagnated (see graph).

NCG received responses from 43 market participants on the market area manager's services, although four did not release their responses for publication.

Germany's other market area manager, Gaspool, held a similar consultation in June.

Participants in Gaspool's consultation also suggested that a merger of the future German VTP with the TTF would lift liquidity. They also proposed that the introduction of intra-day allocations at SLP points — which are not metered on a daily basis, and are largely for delivery to households and small businesses — and more frequent and faster provision of data for RLM points — which mostly connect industrial customers, including gas-fired power plants — would boost liquidity.