Stronger quality conversion could continue to bolster the Netherlands' high-calorie gas imports over the rest of this year, including from Russia.

Russian state-controlled Gazprom sold 2.82bn m³ of gas to the Netherlands in the second quarter, up from 1.74bn m³ a year earlier. The firm had already lifted sales in the first quarter.

This was in contrast to most other markets in Europe, including Germany, to which Gazprom's sales plummeted to 20.1bn m³ in January-June from almost 27bn m³ a year earlier. Sales to the UK also dropped sharply, although the firm registers some deliveries to UK-based marketing and trading arm GMT as sales to other markets, such as the UK and Belgium, even if physical delivery is elsewhere.

Gazprom's sales to the Netherlands were close to 1bn m³/quarter before the 2017-18 winter — in line with its 4bn m³/yr contract with Dutch firm Gasterra. But sales to the country rose to 7.88bn m³ in 2018 and 8.51bn m³ in 2019.

Gazprom and Gasterra settled an arbitration case in June 2017 over their contract, including a price revision. A substantial proportion of deliveries in the contract — which runs to 2023 — is linked to spot prices.

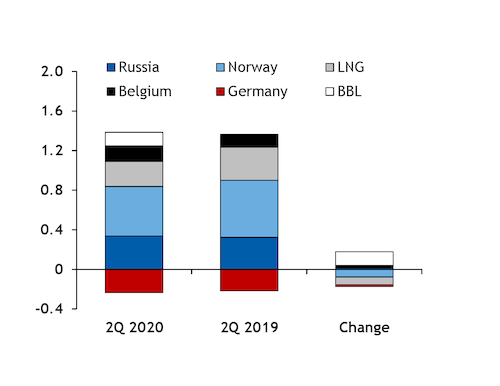

The increase in Russian take was supplemented by brisk deliveries from elsewhere. The Netherlands received 137 GWh/d through the BBL pipeline from the UK in April-June, with physical flows towards the Netherlands only becoming available from July 2019. And high-calorie imports from Belgium climbed to 156 GWh/d from 130 GWh/d.

The rise in deliveries was at least partly offset by slower LNG sendout and weaker Norwegian imports.

But aggregate Dutch import demand rose in the second quarter. It was boosted by stronger conversion of high-calorie gas into low-calorie supply, even as domestic consumption and high-calorie injection demand slipped.

Aggregate Dutch consumption slipped in the second quarter, with low-calorie exports also down.

But converted high-calorie supply rose to 757 GWh/d from 640 GWh/d a year earlier, with nitrogen use up to 8.77mn m³/d from 7.61mn m³/d.

An expansion of the Wieringermeer base-load facility in December last year has allowed for a sharp rise in Dutch quality conversion.

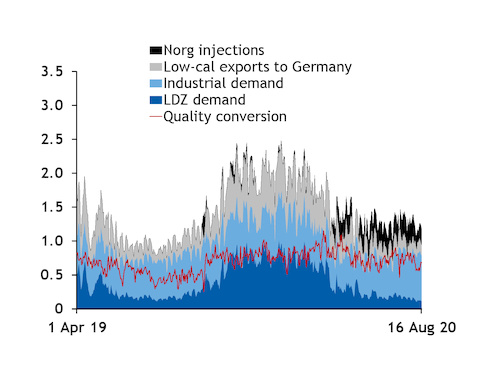

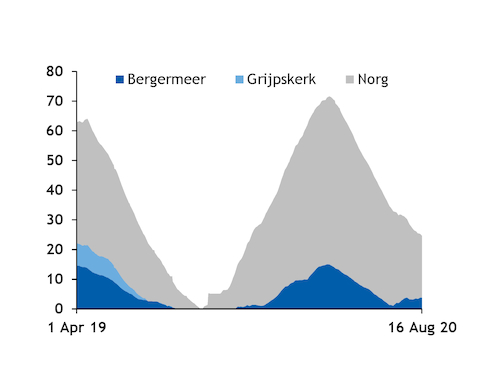

And demand for quality conversion has stayed quick this summer, partly because of injections using converted supply into the Norg storage site for the first time.

In contrast to Norg, high-calorie injection demand slipped.

Dutch high-calorie needs to stay high

Quality conversion could stay strong over the rest of the year, boosting Dutch high-calorie gas demand compared with a year earlier.

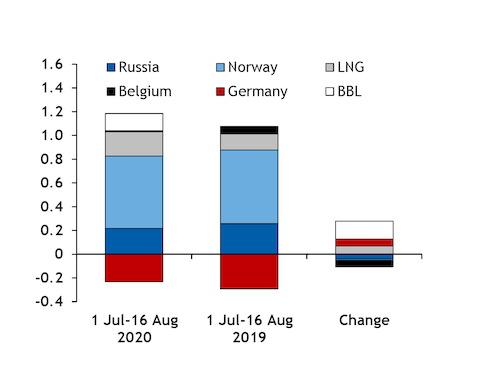

Converted high-calorie supply jumped to 730 GWh/d on 1 July-16 August from 464 GWh/d a year earlier, as Norg injections remained brisk.

And nitrogen availability at GTS' base-load facilities is scheduled to be 9.38mn m³/d over the rest of the quarter and as high as 10.1mn m³/d in October-December, up from 5.19mn m³/d and 9.11mn m³/d respectively a year earlier.

Using 100pc of base-load nitrogen availability, as targeted by GTS for this gas year, and assuming the same ratio between converted supply and nitrogen use as earlier this year, converted high-calorie supply could reach 800 GWh/d over the rest of the summer and 857 GWh/d in the fourth quarter. This would be well up from 478 GWh/d and 761 GWh/d, respectively, a year earlier.

Quick quality conversion could help pare Groningen output further, in line with the field's 2020-21 production plan. The plan stipulates that output of 9.3bn m³ would be allowed, assuming an average number of degree days. This is well down from the 10.7bn m³ allowed under the revised 2019-20 plan, although output is on track to be substantially lower.

Brisk Russian take likely to continue

The Netherlands could continue to rely on quick imports from Russia to meet part of its additional import demand.

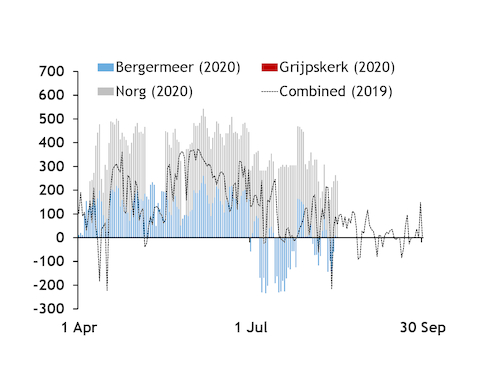

Deliveries to Oude Statenzijl have slowed this quarter from a year earlier. But Russian sales may have remained quick, with Gazprom likely relying on withdrawals from its capacity at Bergermeer rather than physical deliveries to meet demand.

Oude Statenzijl flows slipped to 216 GWh/d on 1 July-15 August from 253 GWh/d a year earlier. But Bergermeer switched to a net stockdraw of 53.1 GWh/d from net injections of 53.7 GWh/d, leaving the site emptier than a year earlier.

LNG sendout has risen to 206 GWh/d from 137 GWh/d. Deliveries from the UK along the BBL have also remained brisk.

Norwegian deliveries into the GTS network have stayed slower, but the year-on-year fall was just 13 GWh/d on 1 July-15 August relative to 77 GWh/d in April-June.

But this was partly offset by a slowdown in high-calorie imports from Belgium.