China's LNG imports rose on the year in July, but the growth rate was well below levels from recent months, as reduced industrial activity following a new wave of Covid-19 cases weighed on demand.

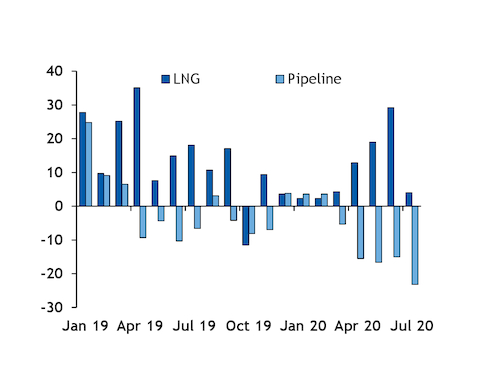

LNG receipts rose to 5.03mn t last month from 4.88mn t a year earlier, the country's customs data show. The year-on-year growth, at 4pc, was sharply slower than the 19pc increase in May and 29.2pc rise in June.

Pipeline gas deliveries fell by 23.2pc to 2.31mn t in July from 3.01mn t a year earlier, customs data show. This was the fifth consecutive month of lower pipeline receipts on the year, as falls in oil prices in March have provided an incentive to maintain slow deliveries of oil-linked volumes in recent months. Pipeline imports fell by 7.5pc on the year in January-June.

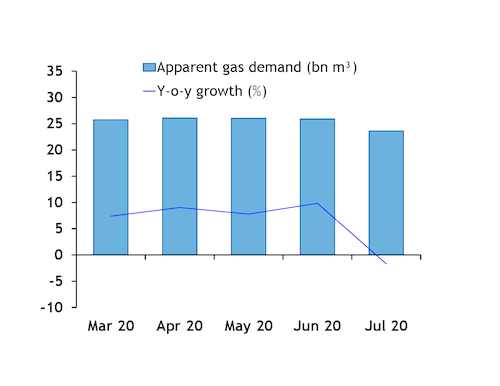

By contrast, China's LNG imports continued to increase in recent months, despite a slowdown in the country's overall apparent gas demand growth following the Covid-19 outbreak at the beginning of this year. Apparent gas demand grew by 7.8pc in January-June from a year earlier, while LNG imports jumped by 11.7pc.

But Chinese economic activity and industrial demand for LNG were hit by an increase in Covid-19 infections in July. Factories that were already operating at lower rates because of reduced international trade and exports as a result of the outbreak had to make further cuts, market participants said. Apparent gas demand slipped by 1.7pc in July, as overall gas and LNG imports fell sharply for the first time since October last year.

LNG import growth could continue to be slow in the coming months if pipeline receipts rebound as Chinese buyers may have to start increasing deliveries to meet their take-or-pay obligations. Oil-linked prices with a six-month (601) indexation period, which showed strong correlation with the prices paid by China for its pipeline gas deliveries, on 21 August were in backwardation until November, while Argus northeast Asia des (ANEA) LNG prices were in contango. This suggests buyers would have an incentive to maximise deliveries of oil-linked volumes in the fourth quarter, when oil-linked prices hold their narrowest premium to corresponding ANEA prices.

But a slowdown in domestic production could create some opportunities for Chinese buyers to absorb additional LNG volumes. China's National Energy Administration (NEA) in June issued a report forecasting a 4.6pc increase in output this year from 2019. Production rose by 9.6pc in January-July, suggesting output growth would have to fall by about 1.8pc on the year in August-December to meet the NEA's target.