A global surplus of jet fuel built up since the Covid-19 pandemic caused an unprecedented fall in demand is prompting suppliers to seek alternative outlets. But the options are limited, and stocks are building onshore and offshore again.

Independent jet stocks in the Amsterdam-Rotterdam-Antwerp (ARA) region rose to the highest on record at 1.03mn t in mid-August, and are now at more than 90pc of that. Floating stocks peaked at 1.3mn t at the same time, and have remained there. This comes even though refiners globally have maximized gasoil output at the expense of jet since demand for the latter crashed around the end of March, and demonstrates how much of a challenge it will be to find a new home for the aviation excess.

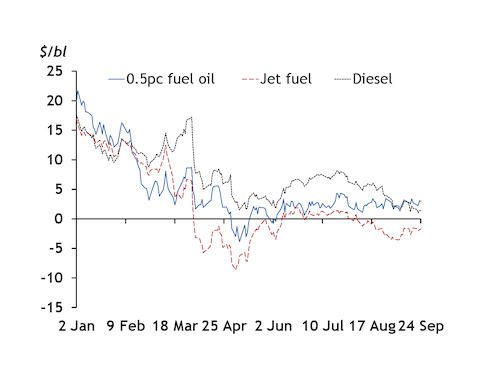

Refiners were encouraged to prioritise gasoil over jet by favourable margins. In northwest Europe, a 68pc fall in jet fuel cracks to the North Sea Dated crude benchmark in the first four months of the year brought the diesel premium to jet to $10.64/bl in April, the highest since Argus started assessing the spread in 1996. Usually jet trades at a premium to diesel during the summer, supported by the peak travel season, but it is now at a discount. In Asia-Pacific, refiners favoured gasoil over jet because the regional regrade — the premium of jet fuel swaps to gasoil swaps — has averaged -$4.94/bl so far this year compared with -$0.65/bl over the same period last year.

But refiners in both regions are close to having maxed out gasoil-to-jet fuel yields, and the extra product is contributing to renewed price weakness in the diesel complex where demand is sluggish. Northwest European diesel cargo margins fell to a 21-year low to Dated this week. So refiners are necessarily looking to shift yields into other higher-margin products to avoid having to cut runs.

Bunker suppliers looking to add jet to marine blending pool

The strength of marine fuel prices over jet fuel has prompted some blending of straight-run kerosene to produce very low-sulphur fuel oil (VLSFO) in Singapore, the world's largest bunkering hub, and in the Middle East.

VLSFO demand fell significantly less than jet fuel during the coronavirus outbreak. Bunker sales in Rotterdam, Europe's largest marine fuels hub, were down by just 1pc year on year in the second quarter, according to the Port of Rotterdam. for comparison, European jet fuel demand fell by 72pc in the same period, according to the IEA.

European VLSFO prices have averaged a $4.95/bl premium to European jet fuel in September, the highest since April, and are at a premium to diesel for the first time since 9 September. While this appears to suggest that blending jet into marine fuels is viable, it is not yet a widespread practice in Europe because of concerns that it could lower the latter's flash point.

Fuel inspectorates in Antwerp told Argus that there is some interest in adding jet into marine fuels, but that it could create issues for blends. "In VLSFO, the prime indication of this new practise is a general reduction in viscosity and density", shipping insurance association UK P&I Club said.

The scale of the problem facing jet fuel suppliers is stark, with demand unlikely to recover to pre-pandemic levels any time soon. The International Air Transport Association (IATA) has said that global travel demand will not return to that seen in 2019 until 2024.