Ukrainian storage operator Ukrtransgaz rejected injection nominations that were higher than available capacity, resulting in rejected nominations for imports from Slovakia.

Aggregate Ukrainian injection capacity has fallen as Ukraine's storage facilities filled. But nominated injections have remained quick in recent days, compelling a rejection of some nominations by Ukrtransgaz. As a result, the country's transmission system operator GTSOU had to reject some nominated imports from Slovakia.

Slovak operator Eustream reported the rejections yesterday, but some nominations at the border had already been rejected on 26-27 September, market participants said.

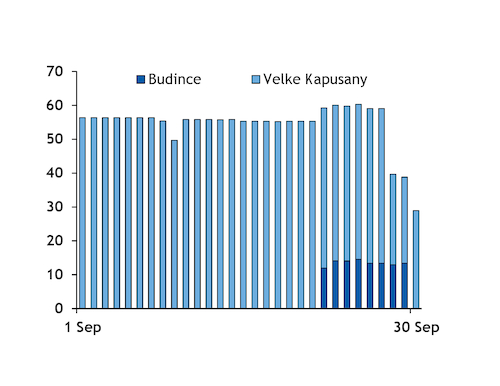

GTSOU adjusted the volume of Slovak imports it could take over the course of each gas day, sources said. While net injections have held roughly unchanged since 26 September, imports from Slovakia fell on 28-30 September, operator data suggested (see nominations graph).

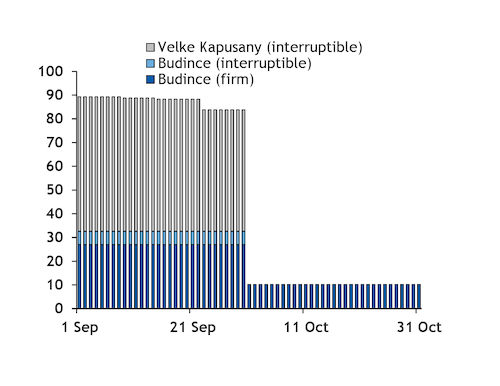

GTSOU prioritised "guaranteed" capacities over bookings made under its short-haul programme, sources said. Short-haul imports have often been paired with storage injections made under Ukraine's customs-free warehouse regime, accounting for a large share of aggregate Ukrainian injections and European imports. The operator retained short-haul bookings on a first-come, first-served basis.

Eustream's notification may have triggered its ability to claim force majeure on its transmission contracts, sources said.

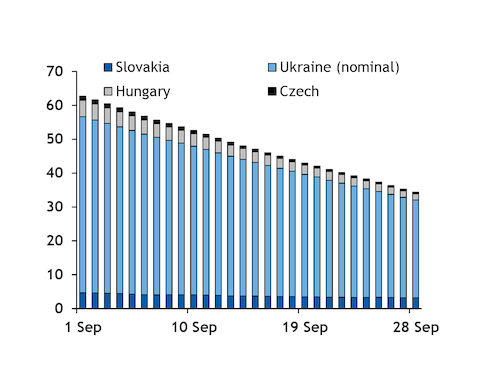

The Ukrainian stockbuild was 75.9mn m³/d on 26-29 September, similar to most recent days. But aggregate imports from Slovakia fell sharply to 39.2mn m³/d on 28-29 September from 59.1mn m³/d on 26-27 September. This was well below booked Slovak exit capacity for 22-30 September of 83.8mn m³/d.

Several European shippers that experienced problems exporting to Ukraine in recent days have had to sell gas in Slovakia instead. And some may have injected to Slovak storage sites, which are still below capacity (see unfilled space graph).

Ukraine's stocks are at their highest for at least a decade, and at some individual sites likely much longer. Most of the country's storage capacity is located in western Ukraine, close to the border with Slovakia, including the 17.05bn m³ Bilche-Volytsko-Uherske site, which held almost 16.6bn m³ on 28 September, the latest data available.

Ukrtransgaz was not immediately available for comment.

The firm has not published aggregate or site-specific injection curves. But aggregate injections strained capacity in August, when stocks were around 25bn m³.

Total stocks were just under 28bn m³ this morning, still well below the technical nameplate capacity of 30.95bn m³. But about 1.13bn m³ of this capacity is unavailable, Ukrtransgaz said previously, suggesting remaining unfilled capacity was closer to 2.19bn m³.

That said, significantly less capacity to Ukraine from Slovakia has been booked for next month, suggesting the problem is unlikely to persist (see capacity bookings graph). Budince will also be removed from the list of eligible short-haul points from 1 October.