Both US presidential candidates' foreign policy visions are likely to become harder to realise, writes Haik Gugarats

It is tempting to think, as US Democratic presidential candidate Joe Biden does, that Washington under his leadership can steer the world to address climate change and the energy transition, and settle regional conflicts and trade wars.

The reality is that the world and the US' position in it were already changing when Donald Trump took office — and his tenure has accelerated that shift in such a way that either winner of next month's election will struggle to implement ambitious foreign policy goals. In simple terms, the US has become a disruptor of the international order that it helped to establish and maintain, creating an opening for regional powers such as Russia and Turkey to assert greater influence in their neighbourhoods by military means and, in China's case, to attempt to match Washington's global reach by economic means.

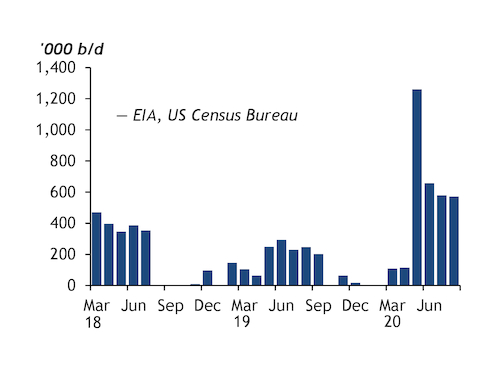

Even Iran and Venezuela have found ways to challenge the US despite its overwhelming military power and its imposition of crushing sanctions. At the same time, growth in US crude production and a lower oil import bill have numbed US policy makers to the need to maintain active involvement in keeping global energy markets stable (see chart). The last upward price shock took place almost a decade ago, and Washington has been happy to outsource solving the problem of low oil prices in 2016 and 2020 to Opec+.

Next year in Tehran

Another disruption in the Middle East balance of power is coming regardless of who wins on 3 November. A victory for Biden would create an opportunity to resurrect the Iran nuclear deal, known as the Joint Comprehensive Plan of Action (JCPOA), by removing sanctions Trump reimposed in 2018 and that have cut off more than 2mn b/d of Iranian crude exports. An election victory for Trump — and the prospect of four more years of "maximum pressure" — would probably prompt Tehran to take a more confrontational stance. The previous bout of US-Iranian disputes in 2019 and early 2020 resulted in attacks on oil tankers, Saudi oil infrastructure and missile strikes targeting each others' forces in Iraq.

That the JCPOA survived in some form is testimony to diplomatic efforts by France, Germany and the UK to persuade Iran not to walk away, in anticipation of a possible government change in Washington. Biden sees reviving the deal as a top priority, for reasons that are not altogether about Iran — a common approach to Tehran would showcase his seriousness in restoring the transatlantic alliance.

Outreach to Tehran would recast the US as a non-confrontational presence in the Middle East, following decades of military interventions that have destabilised the region. But an alliance of convenience between Israel and the Mideast Gulf Arab states, forged under Trump, complicates Biden's task of improving relations with Tehran. And a likely messy transition of government if Biden wins could encourage those states to pre-emptively curb Iran's ambitions. A Trump victory, meanwhile, would place the alliance on the frontline of a US-Iran confrontation.

Diplomacy with Tehran could be mirrored in a more flexible US stance towards Venezuela, where the government has alleviated a fuel shortage with help from Iran. For both US presidential candidates, their Venezuela policy is derived from unrelated domestic issues. Trump has hardened his stance against Maduro and his main patron, Havana, with an eye toward the electoral prize of Florida and its Cuban-American voters. Biden says that sanctions against Venezuela are not working, but his most clearly articulated policy proposal involves granting temporary asylum to Venezuelan migrants in the US — an immigration pitch that appeals to the progressive wing of the Democratic electorate.

While a Biden administration would be hard-pressed to lift sanctions on Caracas, it could lower the bar for negotiations, bringing Washington closer to the less-rigid EU stance of fostering common ground between Maduro and the opposition. But this may involve abandoning US recognition of opposition leader Juan Guaido's claim to the interim presidency — a tough decision for Biden, who has criticised Trump for not doing enough to promote human rights and democracy abroad.

Venezuela's oil production will continue to decline if the US maintains its sanctions pressure in a second Trump term. That output could collapse altogether is a tragic prospect for a country of nearly 30mn people — with almost 6mn having already become refugees in neighbouring countries. A further exodus would create more instability in Colombia, Ecuador, Peru, Guyana and Brazil, with negative consequences for the economies of these oil-producing countries.

Trade war, Cold War or jaw-jaw?

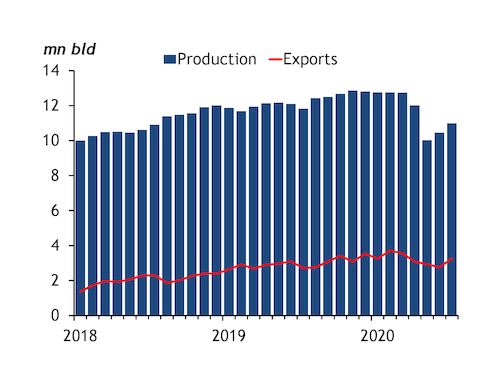

Both candidates share a view of China as the principal foreign challenge for the US in decades to come. A second Trump term would accelerate the decoupling of the world's largest economies, with measures under consideration that could force Chinese state-owned firms, including oil companies, to delist from US stock markets by 2022. China's "phase one" deal to ramp up crude and other energy imports from the US would be a likely casualty of that approach.

Biden says he will terminate US trade wars — a plus for US crude and LNG exporters, which still face tariffs in China. But his team also criticises the phase one deal, and it is an open question as to whether Beijing will continue to encourage its firms to import American crude if Trump leaves office (see chart). The Democrats see a potential opening in discussing the energy transition and climate change with Beijing, with Chinese president Xi Jinping's recent pledge of "carbon neutrality" by 2060 seeming to offer a platform for talks.

At a glance, Russia has much to fear from a Biden presidency, given his promise to hold the Kremlin to account over its alleged interference in US elections. But the sanctions toolbox has been deployed so often against Moscow in recent years that it leaves few new options. Targeting the almost-complete Nord Stream 2 gas pipeline to Germany would test Biden's promise to improve relations with European allies, which have pushed back at the reach of US sanctions.

That dialling up sanctions pressure yields diminishing returns may be becoming evident even to the Trump administration — recent sanctions on Belarus following its disputed election have only narrowly targeted government officials. But Trump's White House shows no willingness to step down pressure on Caracas and Tehran. It has tried to protect its Iran policies from a potential change under a Democratic presidency, as the recent debacle with the "snapback" of UN Iran sanctions shows.

Failing State Department

Whoever wins the election, whether the US State Department has the ability to meet the country's growing foreign policy challenges will be a key question. Secretary of state Mike Pompeo has become unusually involved in domestic politics, visiting swing states to tout Trump's foreign policy accomplishments.

But the incumbent's distrust and persecution of national security and foreign service professionals has demoralised and thinned their ranks in government service, leaving fewer experts to solve an increasing number of crises. That degradation of government competence will be difficult to reverse immediately. The self-induced wound to US diplomatic power is compounded by far greater constraints posed by the burden of containing Covid-19 and extracting the US economy from its deepest recession in almost a century.