South Korean wholesale gas monopoly Kogas sold more to downstream buyers in September than a year earlier, ending an 11-month run of slower sales.

The firm sold around 2.01mn t (86mn m³/d) of gas in September, up from 1.92mn t (82mn m³/d) a year earlier, as it posted higher sales to the power and city gas sectors.

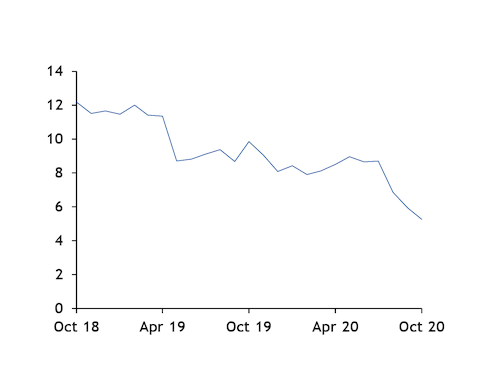

Power sector sales rose to 47.2mn m³/d from 43.9mn m³/d — probably supported by recent falls in Kogas' gas tariff to buyers in the sector. The firm's raw materials cost to the power sector for September slipped to 7,430 won/GJ ($5.94/mn Btu), from W8,647/GJ in August and W11,079/GJ a year earlier. This probably means that gas supplied from Kogas was more competitive compared with less efficient coal-fired plants, displacing some coal burn and increasing power sector gas demand.

Kogas typically secures more of its supply on long-term oil-indexed supply agreements — as well as some short-term, multi-month purchases. The firm provides these volumes based on an average price, known as the raw material cost, and an additional supply cost. As oil-linked prices have remained in backwardation — prompt premiums to forward values — throughout much of the summer and in the fourth quarter, power producers may have decided to backload their 2020 gas purchases, given the likely lower cost of fourth-quarter supplies compared with those earlier in the year.

The raw material cost for October volumes to the power sector has fallen further to W6,459/GJ, suggesting that there remains ample incentive for power producers to take even quicker deliveries from Kogas this month, which could further buoy power sector gas demand.

The firm's city gas sales also rose in September, having consistently fallen on the year since April 2019. Kogas sold around 38.9mn m³/d to the sector, up from 38.2mn m³/d a year earlier. The marginal rise may have been because of cooler weather, with minimum temperatures in Seoul in September averaging 18°C, down from 19°C a year earlier.

City gas demand could be even stronger in October, with overnight temperatures this month falling to around 12.2°C from 14.2°C a year earlier. And minimum temperatures are forecast to average around 8.7°C over the rest of October, down from 10.1°C in the same period last year. But overnight temperatures for November have been forecast at around 4.6°C, compared with 3.8°C in November 2019, suggesting that higher city gas demand is unlikely to stretch much further into the fourth quarter.