More gas transit capacity was booked towards Europe for November at some of Ukraine's border points today, including entry capacity at the Russian border.

Entry capacity of 10.3mn m³/d was booked to Ukraine from Russia at Sudzha.

And there were bookings for entry to Poland, Hungary, Romania and Moldova, but none towards Slovakia at Velke Kapusany (see table).

Gazprom had booked 4.5mn m³/d at Sudzha for October at the previous monthly auction. This was the first time it made shorter-term bookings in addition to the 178.1mn m³/d agreed with Ukrainian counterparts late last year for all of 2020. Ukraine's state-controlled Naftogaz acts as a booking intermediary under the terms of the five-year deal.

The Sudzha booking matched aggregate subscriptions at Grebynyky and Oleksiivka towards Moldova. Gazprom has provided nearly all of Moldova's supply in recent years.

About 5.77mn m³/d was booked back to Ukraine at Kaushany along the Trans-Balkan Pipeline route, with 5.6mn m³/d booked on to Romania and 170,000m³/d — about a third of what was offered — booked for direct offtake to Moldovan consumers near the Ukrainian border.

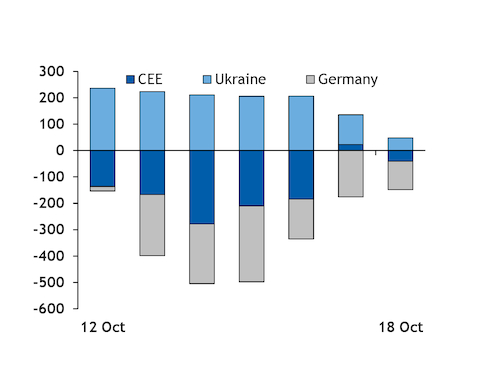

Bookings elsewhere suggested that some firms may withdraw from Ukrainian sites next month and re-export gas westward. Ukrainian injections have continued this month, in contrast to withdrawals over much of Europe in recent days (see withdrawals graph).

European firms injected substantial volumes in Ukraine under the country's customs-free regime over the past summer, which allows them to hold the gas in Ukrainian storage for up to three years without paying customs fees. Some of these firms may have an incentive to re-import this gas if November-summer 2021 spreads hold wider than summer 2021-winter and 2021-22 spreads, once Ukrainian customs, tax and other fees are considered, traders said. Limited Ukrainian liquidity means that some firms have established positions based on incentives in more liquid markets, such as the Austria VTP, Germany's NCG and Gaspool market areas, and the Dutch TTF, traders said.

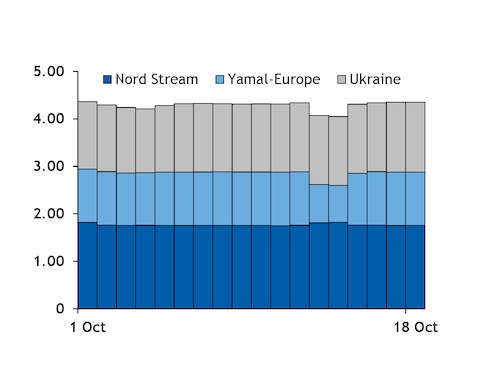

Additional capacity was also booked along Yamal-Europe, which ships gas to Germany through Belarus and Poland, although most capacity had already been booked previously. All capacity offered at the Polish entry point of Kondratki for November was sold. And bookings further downstream at the route's exit to Germany also lifted subscriptions to capacity (see Russian flows graph).

Naftogaz charges Gazprom 70pc of a base $31.72/'000m³ fee for Ukrainian entry capacity. Taking into account a multiplier of 1.2 for monthly capacity, the Russian firm may have paid about $26.65/'000m³ (€2.13/MWh) for its entry capacity. Exit capacity is charged at 30pc of the base fee, to which relevant multipliers are added.

European prices have risen sharply from the front of the curve in recent weeks, which could incentivise quick Russian deliveries to EU destinations next month.

| Monthly capacity bookings, November* | mn m³/d | ||||

| Border point | Market from | Market to | Bundled? | Booked | Offered |

| Sudzha† | Russia | Ukraine | No | 10 | 15.00 |

| Isaccea-Orlovka† | Ukraine | Romania (TBP) | No | 5.60 | 17.19 |

| Bereg VIP† | Ukraine | Hungary | No | 3.80 | 10.92 |

| Bereg VIP | Ukraine | Hungary | No | 4.12 | 14.86 |

| Velke Kapusany† | Ukraine | Slovakia | No | 0.00 | 30.50 |

| Poland-Ukraine VIP | Ukraine | Poland | No | 0.23 | 2.58 |

| Grebynyky† | Ukraine | Moldova (TBP) | No | 7.77 | 26.00 |

| Oleksiivka† | Ukraine | Moldova | No | 2.50 | 5.31 |

| Moldova VTP† | Ukraine | Moldova | No | 0.17 | 0.54 |

| Budince† | Slovakia | Ukraine | No | 0.28 | 15.80 |

| Kondratki | Belarus | Poland | No | 9.87 | 9.87 |

| Wysokoje | Belarus | Poland | No | 0.00 | 6.29 |

| Tietierowka | Belarus | Poland | No | 0.83 | 0.45 |

| — RBP, GSA Platform | |||||

| *TSOs other than Ukraine's GTSOU market in energy units' conversion of 10.58 used; values approximate †Marketed by GTSOU | |||||