Iron ore lump premiums remained under pressure ahead of increased winter demand from rising metallurgical coke costs, looser output restrictions and high lump inventories.

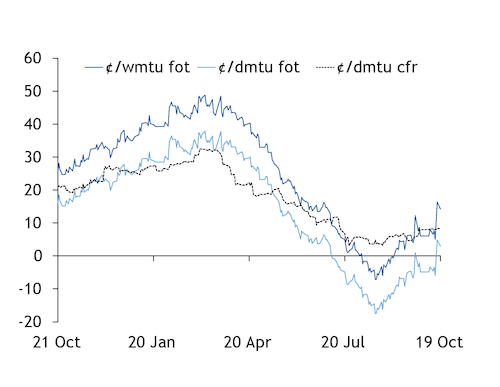

The Argus 62pc seaborne lump premium increased from three-year lows in July-August to 8.3¢/dry metric tonne unit (dmtu) yesterday but still lagged its typical seasonal jump ahead of winter. Portside prices have only recently flipped to a premium on a ¢/dmtu basis.

The Argus seaborne lump premium is the extra cost for every 1pc Fe in lump above the underlying ICX fines index. Demand for lump increases in winter because it does not require sintering like fines before use in a blast furnace, so mills use it to minimise sintering as pollution policies tighten in winter.

"A slow climb up on lump premiums, even after the winter curbs got confirmed this year," a Beijing-based trader said. Lump premiums last winter soared from 17.4¢/dmtu to a high of 32.5¢/dmtu. Lump premiums this year are under pressure from price spikes in the underlying fines index and higher metallurgical coke costs that have narrowed steel margins, and high lump inventories at the ports.

North China winter restrictions are less stringent than expected this year, with more pollution controls installed by industry providing milder support to lump premiums than in previous years. But demand will increase into winter. A Tangshan mill plans to use more lump during curbs on sintering and blast furnace operations to preserve its sintered fines and pellet stocks, a manager at the mill said.

"We see some price potentials for lump premiums as the restrictions get underway, but the upside will be quite limited, at most to 16¢/dmtu," a north China-based trader said.

Portside lump prices only returned to a premium to fines last week, on a ¢/dmtu basis.

PB lump sold at 945 yuan/wmt ($141/wmt) on 16 October in Qingdao where lump stockpiles have run low, which equated to a premium of around 5.8¢/dmtu. Lump still trades negative to fines in Tangshan and Tianjin where stockpiles are much higher. The PB lump and Newman Blend lump inventory is around 3.7mn t in Tangshan, but it less than 1.5mn t in Shandong, a market participant said.

The Argus PBL portside index rose by Yn19/wmt to Yn943/wmt on 16 October, which against the Argus PBF portside assessment at Yn862/wmt equated to a 4.87¢/dmtu basis lump premium.

China's ban on Australian coal imports could limit demand for lump this winter. The ban could limit supply of met coke, which would lead mills to maximise productivity so they can conserve met coke. Lump typically requires more met coke than pellet.

Mills have kept lump ratios unchanged or slightly lower so far, after met coke prices began to rise, making lump slightly unfavourable to use, an east China mill buyer said. "We may continue to lower the lump ratio in winter, after adjusting it previously from 10pc to 8pc now."

The higher cost of lump has shifted demand towards its competing direct-charge products pellet and concentrate.

Winter restrictions have increased demand for direct-charge materials, but the buying interest for pellet is more active than lump because of the high met coke price," a Hebei-based steel mill manager said.

Mills cannot reduce use of met coke because its ratio is fixed in the blast furnace, a Tangshan mill buyer said. "We are slightly increasing pellets usage to replace lump. But the cost of pellets remains expensive given their high grade, and we do not plan to increase the ratio too much. In the near term, we are likely to shift the iron ore blends with medium-Fe and higher-Fe fines to ensure the steel production."

Mills with their own pelletising plants are switching from lump to pellet. A Handan mill increased its pellet ratio to 20pc during restrictions by relying more on pellet made from domestic concentrate.

Some mills might raise the ratio of scrap steel in the furnaces, as they became more cost-effective recently, a Tangshan mill buyer said.