Recovering demand from south Asian markets drove South African coal exports to a nine-month high in September. But lower fob Newcastle prices could intensify competition into certain markets in the next few weeks.

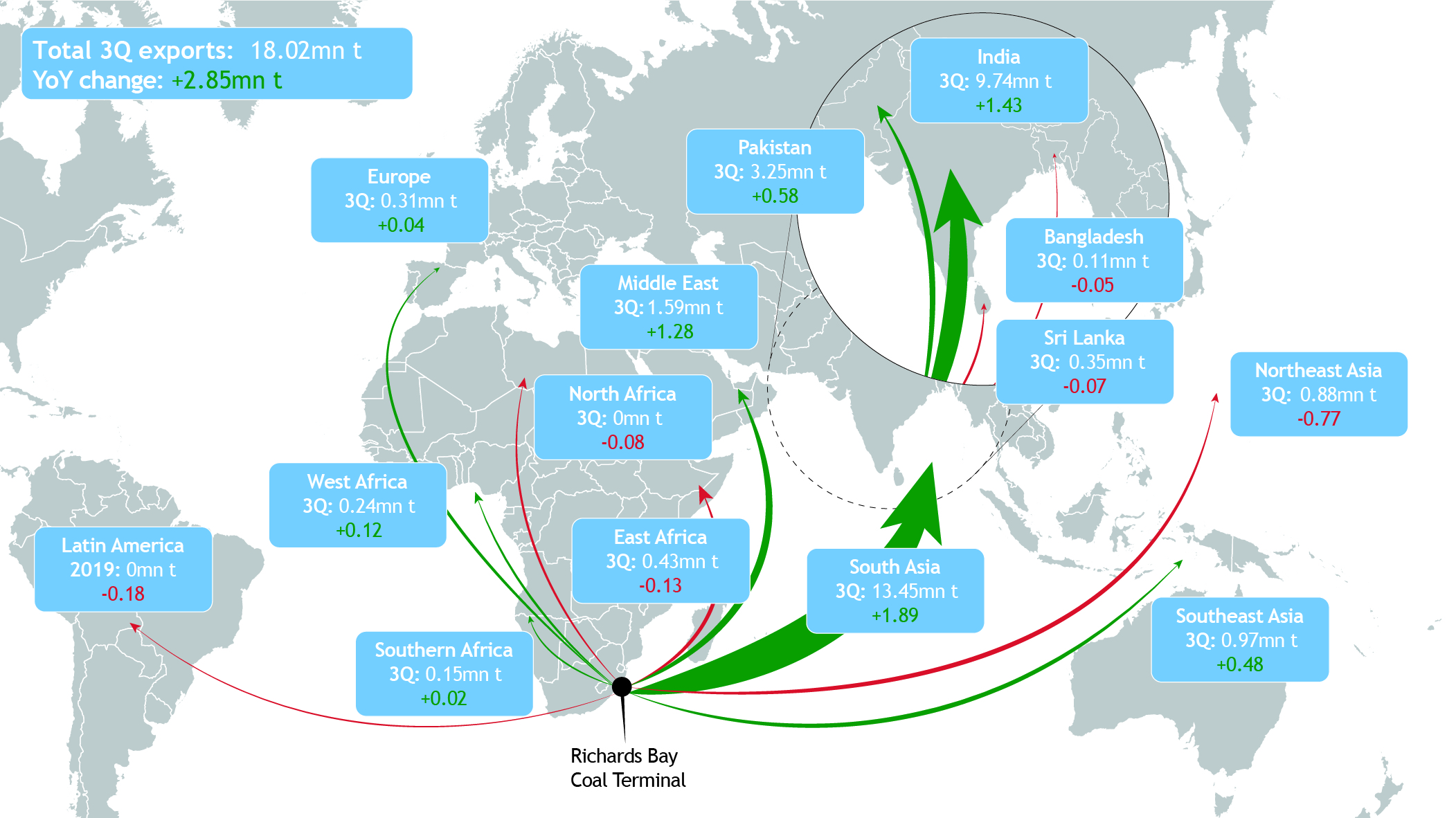

The Richards Bay Coal Terminal (RBCT) exported 6.3mn t in September, up by 1.2mn t on the year, driven by greater loadings for India, Pakistan and Turkey.

Shipments for India grew by 32.5pc on the year and by 2.2pc on the month to 3.4mn t, buoyed by a recovery in both power sector and industrial demand. After being hit hard by Covid-19 in the second quarter, Indian electricity consumption has recovered to seasonal norms while industrial and sponge iron buyers have also sought more South African coal.

Sponge iron consumers typically prefer the characteristics of Richards Bay (RB) product over other origins owing to its fixed carbon content, which should support purchasing for the remainder of the year. And some industrial users have turned to coal in recent weeks due to rising petcoke prices, which could further maintain seaborne imports.

But a government push to boost domestic coal consumption as well as falling Australian coal prices are headwinds for demand in the fourth quarter.

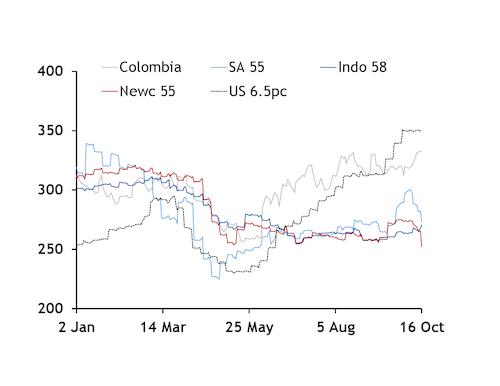

Fob Newcastle prices have fallen sharply in the past couple of weeks and are now pricing more competitively into India and other markets, which are major buyers of South African coal.

The landed and taxed cost of sending Newcastle NAR 5,500 kcal/kg coal to inland Indian plants fell to around 252 rupees/mn Btu($3.42/ mn Btu) last week, around Rs20/mn Btu below the equivalent RB NAR 5,500 kcal/kg cost, according to Argus calculations. By contrast, the two origins were pricing at close to parity for much of June-September (see chart).

Competition from Australian coal has also intensified into the Pakistani market. One trader said he purchased an Australian cargo for Pakistan last week, along with several South African cargoes.

RBCT exports to Pakistan rose by 54.3pc on the year and 16.7pc on the month to 1.2mn t in September. Overall Pakistani coal imports have been strong in the past couple of months but higher seaborne coal and freight prices, coupled with greater competition from imported LNG in the power sector, could weigh on fourth quarter receipts.

Strong Turkey deliveries

RBCT exports to Turkey hit a five-and-a-half year high of 500,000t last month, up from just 78,000t in September 2019.

Strong power demand and less competition from Colombian suppliers thanks to production disruption boosted shipments to this market in the third quarter. Aggregate July-September exports grew by 845,000t to 923,000t.

On the flip side, RBCT exports to South Korea are lagging last year. September exports slipped by 66.7pc on the year to 155,000t, while year-to-date flows more than halved to 1.2mn t. Stronger coal-to-gas fuel switching and higher nuclear output are likely to curb South Korean coal imports for the rest of 2020.

Aggregate January-September RBCT exports lag last year by 1.3pc at 50.4mn t.

RBCT stocks are around 4.5mn t, up by 130,000t on the week and flat on the year.

After exceeding $60/t in late September for the first time since April, Argus' NAR 6,000 kcal/kg prompt two-month assessment has trended lower in the past couple of weeks, taking its cue from falling Australian prices. Differentials for off-specification coal have remained relatively stable but outright prices have decreased in line with a fall in the API 4 paper market.