Negotiations between South Africa's largest coal miners and labour unions have been taking place in recent weeks, with unions threatening widespread strike action.

Discussions are at different stages depending on the firm, but the challenging economic backdrop could provide a disincentive for large-scale disruption.

South Africa's National Union of Mineworkers (NUM) this week warned that it will "not hesitate to embark on protected strikes" at coal operations over wage disputes. NUM name-checked several of South Africa's largest mining firms in its statement on 28 October, including Exxaro, Anglo American, South32, Glencore and Seriti Resources.

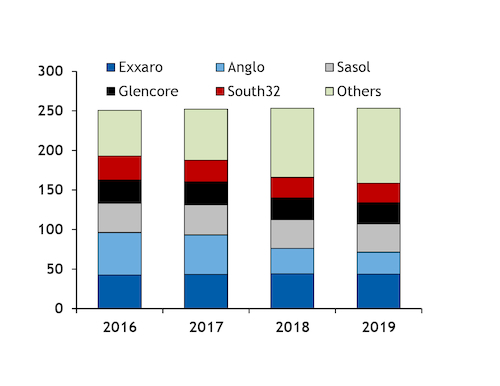

Together, these firms produce just over half of South Africa's 250mn t/yr of coal output, with the first four being the largest players in the country's 75mn t/yr export market.

A spokesperson for Glencore, which exported about 13mn t of South African coal last year, refuted NUM's statement, saying the Switzerland-based mining firm settled its wage negotiations with the union last week.

But negotiations are at an impasse with Anglo American, which produced 17.8mn t of South African export coal in 2019.

"Anglo American Coal confirms that the 2020 wage negotiations with NUM have reached a deadlock," a spokesperson for the firm said.

"The wage negotiations are happening against a challenging external environment. We will continue our engagements with NUM with the view of reaching an agreement in the interest of all parties."

It is this difficult backdrop, with workers' incomes squeezed amid the Covid-19 pandemic, that could make it challenging for unions to convince their workers to strike, participants said.

One producer said that while his firm's unions were "making noises" about striking, the workers' loyalty, economic difficulties facing them at present and financial incentives on offer to maximise their individual mining output could deter strike action.

NUM said South32, which sold 10.5mn t of export coal last year, offered to keep wages flat for the coming period, to the chagrin of the union.

"Wage negotiations are scheduled for later this financial year. We regularly communicate with NUM and will continue to engage with our labour partners, all our employees and stakeholders," a spokesperson for South32 said.

The country's largest producer, Exxaro, which exported about 9mn t last year, offered a wage increase of 5pc, short of NUM's 7.5pc request.

Earlier this month, Exxaro said it was "engaging in discussions" to find an "amicable resolution" to the dispute, but was not able to provide an update by the time of publication.

Challenging environment for miners

Any shortfall in fourth-quarter production could dent the industry's nascent recovery following the peak of the Covid-19 lockdowns in the second quarter.

After falling by 8.4-10.7pc on the year between April and July, South Africa's August coal production slipped by just 4pc on the year, government data show.

Earlier this year, firms were forced to run underground mining operations at 50pc because of Covid-19 restrictions, which meant some producers opted to place these facilities on to care and maintenance, according to Henry Johnson, chief financial officer of energy investment firm Menar Group, which manages several South African coal mines.

Speaking at industry event Coaltrans on 28 October, Johnson said this was particularly the case for mid-cap and junior mining companies, which have greater flexibility to scale back and ramp up operations than the larger firms.

Some larger firms have placed individual pits on care and maintenance — for example, South32 with its Wolvekrans operation. But Johnson said that given the large take-or-pay exposure of the big five South African mining firms, as well as their sizeable overheads, fixed-cost structures and slower reaction time because of their regulated structure, it is more difficult to react quickly to changing market dynamics.

Mining companies' margins in the export market have been squeezed by declining global energy demand, although this has been cushioned by the rand's devaluation against the US dollar.

Argus' fob Richards Bay NAR 6,000 kcal/kg assessment has averaged $54.98/t since April, compared with $78.73/t in November 2019-March 2020.