No gas transport capacity was booked at Ukrainian entry or exit points at today's quarterly auctions, suggesting that Russia's state-controlled Gazprom may need extra delivery capacity only during some of the next quarter, if at all.

The firm's aggregate booked transport capacity through Ukraine will fall to 109.6mn m³/d next year if it does not make monthly or shorter-term bookings. Capacity was offered today for the remaining three quarters of the gas year, but little was sold along routes where Gazprom typically makes deliveries, except at Mallnow towards Germany from Poland (see table).

Gazprom had hoped to have commissioned its planned 55bn m³/yr Nord Stream 2 pipeline by the start of 2021, mitigating the need for capacity through Ukraine. But construction of the route has yet to restart since being suspended late last year owing to US sanctions. It is unlikely to operate before the end of March, given remaining construction work and regulatory processes.

The firm may be able to rely on existing booked capacity and storage withdrawals to meet customer nominations over the rest of winter. This will partly depend on how restrictions aiming to limit the spread of Covid-19 recently imposed by European governments influence consumption. Further restrictions were included as a relevant factor for the firm's sales by Gazpromexport general director Elena Burmistrova late last month.

Gazprom may be able to meet its customers' nominations using gas held in storage and existing booked delivery capacity, depending on demand. It earlier said it was aiming to hold 9bn m³ in European gas storage sites before the start of the withdrawal season. The target was "already practically" reached late last month, Burmistrova said.

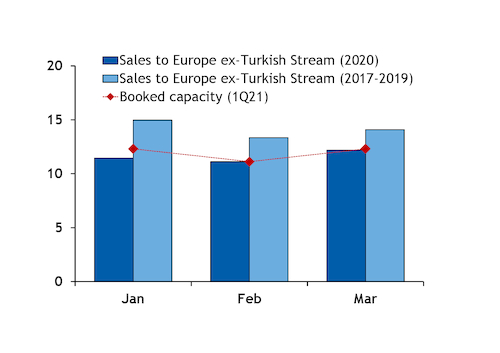

Gazprom could maintain first-quarter sales to Europe, excluding the Baltic states and countries served by Turkish Stream, flat with a year earlier without booking more transport capacity or withdrawing from storage, assuming Yamal-Europe and Nord Stream flows in line with maximum capacity (see sales scenario graph).

In order to bring sales in line with the first-quarter average over the previous three years without booking more transport capacity, withdrawals would need to total 6.7bn m³ (see data and download).

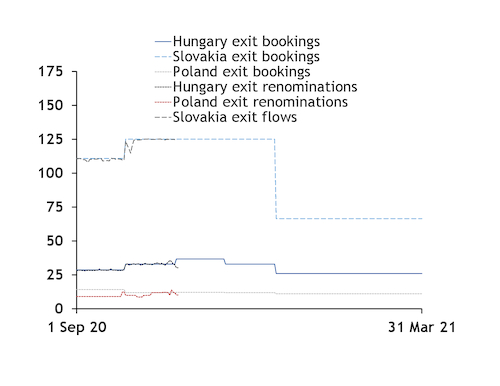

Gazprom uses Ukraine as its marginal route for gas deliveries to Europe, with flows along the Nord Stream and Yamal-Europe pipelines running near capacity on most days. The firm booked extra capacity through Ukraine for this month and for October (see flows graph).

Ukraine gas stocks could remain high

No quarterly bookings for Ukrainian transport capacity may also suggest that firms do not plan consistent withdrawals to Europe from Ukrainian storage early next year.

Firms made some withdrawals during the last 10 days of October, with shipments to Hungary climbing above capacity booked prior to the month. This may have been in response to capacity constraints along the Hag pipeline on 21-29 October.

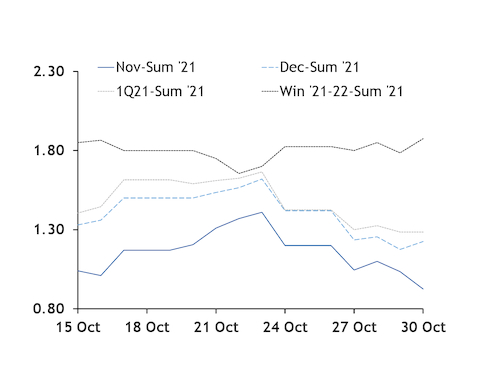

And the absence of bookings for January-March may also suggest little incentive to unwind hedged positions that market participants earlier said meant that much of the gas added to Ukrainian sites this summer would be carried over for withdrawal next winter. TTF prices for delivery over the rest of this winter have held below the winter 2021-22 price, providing a firm incentive to leave gas in storage (see TTF spreads graph).

| First-quarter 2021 capacity auction results, central and eastern Europe | mn m³/d | ||||

| Border point | Country from | Country to | Bundled? | Booked | Offered |

| Sudzha | Russia | Ukraine | No | 0.00 | 15.00 |

| Grebenyky | Ukraine | Moldova | No | 0.00 | 17.10 |

| Kaushany | Moldova | Ukraine | No | 0.00 | 32.02 |

| Isaccea-Orlovka I | Ukraine | Romania | No | 0.00 | 17.19 |

| Bereg VIP | Ukraine | Hungary | No | 0.00 | 17.92 |

| Velke Kapusany | Ukraine | Slovakia | No | 0.00 | 73.00 |

| Poland-Ukraine VIP | Ukraine | Poland | No | 0.00 | 2.86 |

| Kondratki | Belarus | Poland | No | 0.00 | 9.87 |

| Wysokoje | Belarus | Poland | No | 0.00 | 6.50 |

| Mallnow | Poland | Germany | Yes | 7.85 | 8.81 |

| Lanzhot | Slovakia | Czech VTP | Yes | 3.40 | 27.27 |

| Oberkappel | Austria | Germany | Yes | 1.13 | 1.44 |

| Oberkappel* | Austria | Germany | No | 2.53 | 3.60 |

| — RBP, GSA Platform, Prisma | |||||

| *Entry capacity only | |||||