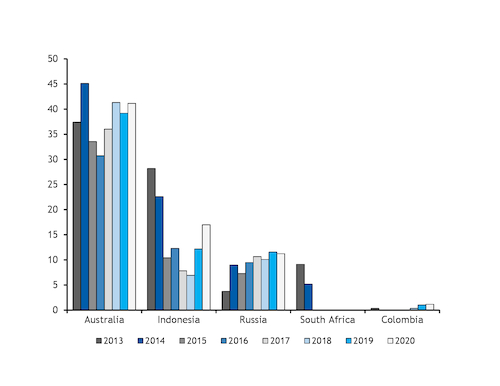

Chinese utilities and cement makers are buying high calorific-value (CV) coal from suppliers as widespread as Russia, Colombia and even South Africa to compensate for restrictions on Australian imports.

Australian bituminous coal is normally the first choice for Chinese buyers, given short journey times and abundant supply. But unofficial government curbs on Australian imports are forcing buyers to look to other sources, often at significantly higher prices.

At least two Capesize cargoes of Colombian NAR 5,500 kcal/kg coal were sold recently to Chinese buyers at undisclosed prices. Another Capesize cargo of Colombian NAR 5,800 kcal/kg coal was offered to China at $44/t fob for loading in the first quarter of 2021. Colombian coal is rarely sold to China because of long shipping distances, unless Australian coal prices are particularly strong. In this case, Beijing's curbs on Australian coal have left Colombian coal more attractive than usual to Chinese buyers.

One major Chinese cement producer is considering buying spot Russian or Colombian high-CV coal because of a lack of Australian coal supplies.

In addition to the spot deals, a large east-China based utility that has previously been a major buyer of Australian coal is in talks with traders to buy high-CV Colombian coal on a term basis next year. This is despite the long shipping time of around two months and the 6pc import tax imposed by China on coal from countries other than Australia and the 10-member Association of Southeast Asian Nations (Asean) group.

"We are trying to secure high-CV coal sold by any other countries possible next year," an official at the utility told Argus. The company has yet to test whether the coal is suitable for its boilers.

Possible risks

The strategy may pose some other risks as well. A drawn-out strike at the Cerrejon mine in Colombia has added to uncertainty over the reliability of supply. Colombian coal exports registered their steepest year-on-year decline so far this year in September, hit by the strike and mine suspensions because of a weak economy. Coal shipments from the country fell by 3.12mn t on the year to 2.93mn t in September, the lowest since 2013.

Chinese buyers have been purchasing more Russian high-CV coal in recent months, as Beijing's restrictions slash intake of Australian coal. This has led to a spike in Russian coal prices. Argus assessed the market for NAR 5,500 kcal/kg Russian coal at $58/t fob Vostochny on 6 November, up by almost 24pc from $46.92/t fob on 18 September.

Even South African coal, which typically breaches China's fluorine limits for imports, has been sold to China. At least two Capesize cargoes of South African coal were recently sold at around $57-60/t cfr China for arrival early next year, in the first such deals since China set limits on trace elements at the start of 2015. The fluorine content of the two cargoes may have been lowered through blending.

China's renewed demand for Colombian and South African coal may provide some support to coal prices in these countries, although some market participants doubt whether the coal can be sold to China in large volumes.

Colombian 11,300 Btu/lb coal prices have registered two straight week-on-week declines to hit $53.25/t fob Puerto Bolivar on 6 November, according to Argus' assessments.

China's demand for high-CV Indonesian coal has also increased. But its higher sulphur content, at maximum 1pc or 1.2pc, has reduced the amount that can be used by Chinese utilities.

The stepped-up government restrictions on Australian coal have hit the country's exports to China in the past three months. Deliveries of Australian bituminous coal — the only type of thermal coal it sells to China — fell to 2.49mn t in September, the lowest since December last year.

Some Chinese traders and importers are cautiously optimistic that any de-escalation of US-China tensions following Joe Biden's victory in last week's US presidential election could help improve Australia-China relations. But other traders said it may take a long time to heal the China-Australia rift and are planning to proceed carefully.