Senior officials in US president Donald Trump's administration are stepping up efforts to prevent their "maximum pressure" policy towards Iran becoming dead letter when Joe Biden takes over the White House on 20 January.

Biden's election victory provides a path for Iran's return to oil markets, even if the timing is far from certain. Domestically, Biden faces few challenges if he makes good on his vow to lift US sanctions against Tehran and rejoin the Iran nuclear deal — also known as the Joint Comprehensive Plan of Action (JCPOA) — as long as Iran resumes compliance with all restrictions on its nuclear programme. But current US officials are taking advantage of a disputed transition of power in Washington to encourage Middle Eastern countries that share a hardline view on Tehran to stand firm in opposition to Biden's proposed renewed engagement, and to pursue closer military co-operation against Iran.

"Our efforts to protect the American people from the regime in Tehran will not cease," secretary of state Mike Pompeo says ahead of visits this month to Israel, Saudi Arabia and the UAE. The State Department's Iran and Venezuela envoy, Elliott Abrams, visited the three countries for consultations on Iran on 7-12 November. And Pompeo on 10 November approved a $23.4bn sale of advanced weaponry to the UAE, including 50 F-35 fighter jets, explaining the sale by Abu Dhabi's need "to deter and defend itself against heightened threats from Iran".

Pompeo is publicly backing his boss' refusal to concede defeat, but his Middle East visits reflect a calculation that an appeal to fellow Iran hardliners offers the only remaining way to prevent an overall unsuccessful policy from being retired with the Trump presidency. Administration officials are at the same time making an indirect pitch to the Biden team not to walk away from their policy. "We are building up a lot of leverage, and our hope is that it will be used wisely and not simply discarded," Abrams says.

This effort — just like the recent, unsuccessful US gambit to force the UN Security Council to snap back oil sanctions against Tehran — seems designed to provoke Iran into overreacting and irrevocably leaving the JCPOA. Tehran, which has acted with restraint in anticipation of a Biden win, says it is ready for dialogue with its neighbours. "Trump's gone in 70 days but we'll remain here forever," Iranian foreign minister Mohammad Javad Zarif says. "Betting on outsiders to provide security is never a good gamble." The planned UAE weaponry sale has already sparked an arms race between US allies in the region. Qatar is lobbying the White House to allow it to buy F-35s as well, as Doha's confrontation with Riyadh and Abu Dhabi remains unresolved.

The resilience game

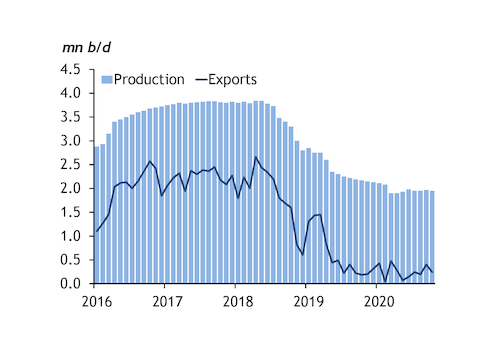

The general consensus among Iran watchers is that the country will be able to increase crude output — estimated by Argus at 1.95mn b/d in October — and use crude and condensate inventories built up during the sanctions period to ramp up exports, if the US measures are lifted (see chart). Tehran insists that the rollback of certain restrictions on its nuclear programme is reversible, and says it has maintained relations with UN nuclear watchdog the IAEA, allowing its inspectors to provide insight if an agreement emerges.

Even limited sanctions relief could pave the way for the re-emergence of up to 1mn b/d or 1.5mn b/d on to global markets at some point in 2021. A potential return of Iranian crude is manageable even as Opec+ weighs up whether to extend its current 7.7mn b/d crude production cut into next year, Saudi oil minister Prince Abdulaziz bin Salman says. "It is safe to bet on the resilience of Opec+," he says.