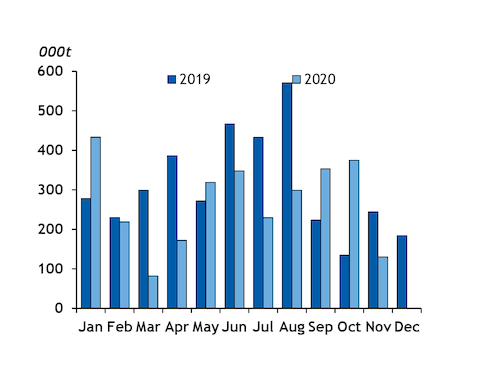

Eurobob gasoline barges traded at prompt Argus loading dates dropped to 236,000t in November from 456,300t in October and 380,500t a year earlier, as the return of strict Covid-19 travel restrictions in several European countries resulted in a sharp retraction in regional demand.

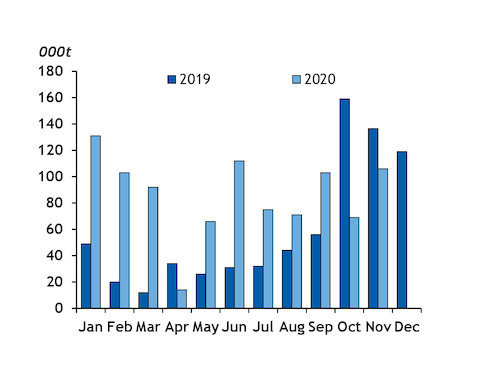

A total of 130,000t of Eurobob oxy barges changed hands in November, from 375,000t in October and 244,000t a year earlier. The monthly total was the lowest since March, with total 2020 oxy volumes down by 16pc for the year to date at 2.96mn t.

Restrictions imposed this autumn to tackle resurgent cases in several European countries will have weighed heavily on demand. The latest forecasts by market participants have put gasoline demand at 15-20pc below year-ago levels in November and December, but the drop could be as much as 40pc in some countries.

Gunvor was the largest buyer in November, securing 74,000t of Eurobob oxy barges, up from 12,000t in October. BP's purchases dropped to 34,000t from 305,000t in October and 132,000t in September. The remaining volumes were purchased by BMV Mineral, Glencore, Litasco, Mabanaft, Shell and Trafigura.

Total remained the largest seller for the second month, parting with 80,000t of oxy gasoline in November, up from 126,000t in October. ExxonMobil sold 16,000t after selling none in October. And Glencore parted with 12,000t, down from 24,000t the previous month. BP, Finco, Litasco, Macquarie and Shell sold the remaining volumes.

Non-oxy barge volumes reached a five-month high of 106,000t in November, up from 69,000t the previous month. Liquidity is down from 244,000t a year ago, when Argus first moved to a volume-weighted average assessment for non-oxy.

Varo remained the largest buyer, securing 79,000t of non-oxy gasoline in November, up from 65,000t in October. Gunvor bought 24,000t, up from 3,000t in October. BMV Mineral and Van Raak purchased the remaining volumes.

ExxonMobil recorded its largest monthly volume to date, parting with 57,000t of non-oxy, down from 4,000t in October. Total sold 20,000t of non-oxy Eurobob in November, up from 11,000t in October. And Shell sold 12,000t, down from 18,000t a month ago. Finco, Litasco and Phillips66 sold the remaining volumes.