Strength in Australian coal prices and a colder outlook in northeast Asia supported the South Korean market this week, while recovering crude prices pose an upside risk for prices and demand in 2021.

Argus assessed NAR 5,800 kcal/kg coal with maximum 1pc sulphur at $60.69/t fob Newcastle and $68.84/t cfr South Korea this week, which were up by $5.21/t and $4.69/t on the week, respectively.

State-owned utility Korea South-East Power awarded 130,000-150,000t of minimum NAR 5,600 kcal/kg coal for February loading in a tender this week in the high $63s/t on a fob Newcastle, NAR 6,080 kcal/kg price basis.

And utility Korea Western Power awarded two Panamax cargoes of NAR 5,600 kcal/kg coal for December and January loading at $62-63/t on a fob Newcastle, NAR 6,080 kcal/kg price basis.

The South Korean market drew strength from the wider Asia-Pacific region, with supply tightness in Australia and colder forecast temperatures squeezing the fundamental balance. Australian exports are expected to fall on the year because of restrictions in China, but producers are also planning to extend mine closures over the festive period to avoid a glut of supply.

On the demand side, December temperatures in South Korea and Japan are forecast to be much colder than last year.

The Korean weather office says there is a 40-60pc chance of below-average temperatures for the rest of the month, but heavy restrictions on the use of the country's coal fleet means there is no resulting upside potential for coal burn. The same is not true in Japan — another big seaborne importer — where coal would likely play a key role in balancing electricity supply in the event of weather-driven spikes in demand.

Demand-side risks in Japan were also raised today by news that a Japanese court ordered the government to revoke the operational permits for the Ohi 3 and 4 nuclear reactors on earthquake safety grounds.

The two units have a combined capacity of 2.36GW, equivalent to around 610,000 t/month of NAR 6,000 kcal/kg-equivalent coal burn at 40pc efficiency. Both units are currently down for planned maintenance, but their scheduled restart on 1 January 2021 and 13 February 2021, respectively, is now in doubt.

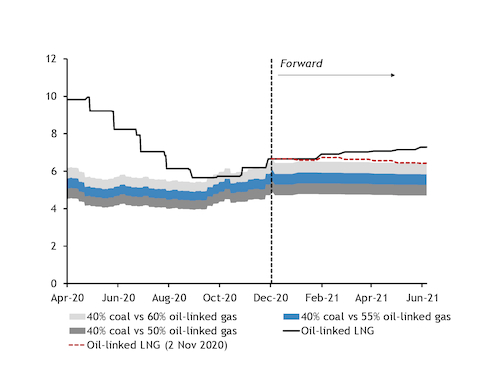

Further out on the forward curve, recovering oil prices since the end of October — in the wake of recent positive Covid-19 vaccine news — have created fresh upside potential for coal prices and demand later next year.

Weaker oil prices since spring have pushed oil-linked LNG supply towards coal-switching prices in South Korea in recent months, potentially displacing some of the solid fuel from the power mix. But if the recent recovery in oil prices holds or is extended further, term LNG supply would become increasingly uncompetitive with coal next year in South Korea and elsewhere in the Asia-Pacific.