Strong global demand for billet and wire rod encouraged some CIS producers to redirect volumes to exports or increase production, reducing rebar supply.

The most significant reduction in rebar sales was seen in Europe, where tight trade restrictions and slower buying activity during the Covid-19 pandemic dampened interest in overseas material, which was higher only when quota allocations were renewed every quarter. Just a few markets in Asia, such as Hong Kong, lifted imports from Russia earlier this year, when Chinese prices were bullish on strong demand, while most of the world was struggling with sluggish trading because of Covid-19.

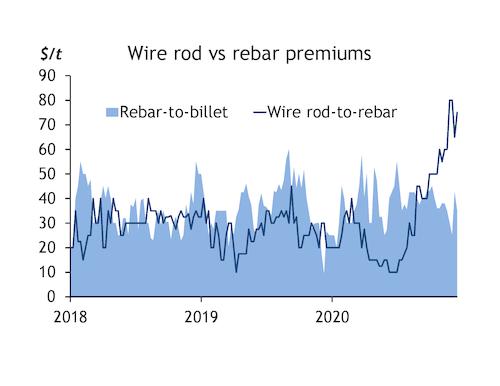

At the same time insufficient wire rod supply in Europe encouraged non-EU suppliers to raise margins for wire rod, with little-changed export shipments. In the past few weeks the wire rod premium over rebar rose to more than $60/t compared with no more than $40/t in the preceding months. Given that competitors in Turkey were unable to meet untypical demand from the domestic and export markets — including South America where local production was temporarily reduced owing to the virus outbreak but consumption remained strong — one Russian producer focused on wire rod sales. That said, Turkish wire rod producers were offering March-April shipment with some holding back from offering. Wire rod production is now more profitable than trading with rebar or even billet, a CIS market participant said.

Following semis restocking in Asia earlier this year, appetite for wire rod and a severe scrap shortage in the international market in late 2020 pushed many longs producers to purchase billet to meet, in particular, huge demand for wire rod. This led to a hike in the Argus daily Black Sea billet assessment from the lowest point of this year at $326/t fob on 3 April to $440/t fob on 19 November. It then jumped by a further $130/t in a month, to $570/t fob. Furthermore, billet offers from CIS and Turkish mills hit $600/t fob this week.

The Philippines and other Asian markets continued to show strong interest in imported billets, with periodic demand coming from South American markets. Some CIS producers sacrificed domestic volumes in order to sell additional billet volumes to export markets. But in the past week the bullish sentiment in the global arena caused a rapid rise in domestic prices in Russia, suggesting tight supply in the billet market and the uptrend will continue well into the first quarter of 2021.