Ukrainian corn exports have remained strong over the first four months of the 2020-21 marketing year, despite a year-on-year decrease of 6mn t in production. But it will be difficult for the country to maintain the current export pace, given strong competition from other global suppliers.

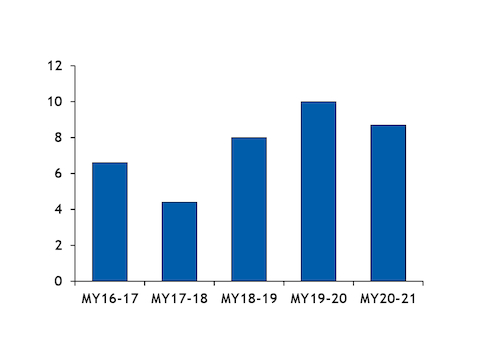

Ukraine's corn exports since the start of the marketing year in September had reached 8.7mn t by 30 December, down by 1.3mn t from the record 10mn t exported over the same period last year, according to official data. But this was still the second-highest volume to have been shipped over the first four months of a marketing year on record.

The fast pace of exports has been supported by strong demand from China, which has significantly increased its purchases of corn this season, owing to greater buying interest from the country's animal feed sector following the resumption of swine breeding.

Ukrainian corn exports to China have nearly tripled, with more than 3.5mn t of the grain having shipped since 1 September, compared with just 1.3mn t over the same period of last year. And total exports to China are expected to reach about 7mn t by the end of the 2020-21 marketing year, up by 1.5mn t from the record 5.5mn t exported in 2019-20.

But in 2021 Ukraine may face stronger competition from US corn supplies for Chinese demand, with US sellers having already begun to take away Ukrainian share in the Asian market.

Only 500t of corn had been exported from Ukraine to South Korea by 30 December, compared with 600,000t over the same period last year, while in contrast South Korean purchases of US corn had reached 1.1mn t by 17 December compared with only 10,000t over September-December 2019.

Ukrainian corn has started to lose its competitiveness in major importing countries, not only because of reduced export supply availability, but also because of higher prices.

On 1 September, the spot price for Ukrainian corn stood at around $184/t fob Odessa and held a premium of roughly $13/t to the US corn fob Gulf price. But on the same date of last year, the value stood at $156/t fob and at a $1/t discount to the US price, according to Argus' agricultural division Agritel.

Higher prices for Ukrainian corn have already affected demand from the EU, with exports to the bloc ending December around 2mn t lower year on year at 2.7mn t.

Recent gains in US corn prices may allow the global demand for Ukrainian corn to partially recover at the start of 2021, but from March Ukraine will face strong competition from the new corn crop harvest in Argentina, meaning it could struggle to achieve its 24mn t corn export target for 2020-21.

30122020031739.jpg)