Measures brought in to curb the spread of Covid-19 have changed Europe's refinery landscape, permanently in some cases, but the regional bitumen market has weathered the storm better than many other oil products.

Road work has largely continued during the pandemic, propping up bitumen consumption at a time when a dramatic drop in other economic activity has slashed demand for transport fuels. Margins were supported during the summer months last year when demand picked up and supply was tight, exacerbated by refinery run cuts. Bitumen should continue to be a strong performer in Europe in the year ahead, maintaining healthy margins during the peak paving season from March to November.

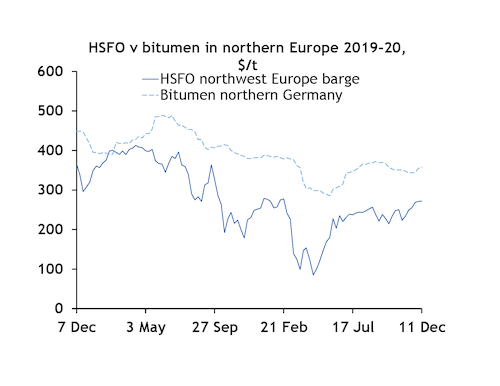

Bitumen exports are predominantly priced as a differential to high-sulphur fuel oil (HSFO) assessments. While HSFO also performed well in 2020, its price disconnect with bitumen could widen this year, with US demand for HSFO set to shrink and global production rebounding.

The relationship between bitumen and HSFO will be volatile, but Argus expects bitumen to increasingly become the more in-demand product. This summer its premiums to HSFO could increase to well above $100/t for cargo exports in northwest Europe and close to that level in the Mediterranean. The highest premium last year was around $85/t in August.

The case for wider adoption of outright bitumen pricing in Europe will increase. Major buyers such as Algeria's Sonatrach have already offered an outright price as an option in import tenders. This trend, already the norm in Asia-Pacific, could accelerate in 2021 if HSFO prices become more volatile.

Bitumen was in tight supply in Europe in 2020, driven by unexpected refinery shutdowns — notably in France — together with run cuts and a lack of supply of bitumen-rich crudes. Capacity is set to be even more constrained this year, with Total and Finland's Neste permanently closing their respective bitumen-producing refineries in Grandpuits near Paris and in Naantali. More closures could be on the way as the pandemic continues to takes its toll on Europe's struggling refiners, especially those running simple refineries. Furthermore, refinery upgrades will also have a negative impact on output of heavy products such as bitumen and fuel oil.

While European bitumen supply is poised to tighten further, demand should be fairly steady as governments look to spend to recover from the pandemic. This will bolster margins during the paving season, while globally demand for any surplus European bitumen will come from the Americas, Africa, the Mideast Gulf and Asia-Pacific.