Ukraine is likely to significantly slow its sunflower seed crushing operations from April, after 2020-21 sunflower seed production turned out significantly lower than forecast and following a large volume build-up of crushed seeds over the September-December 2020 period.

Sunflower seed stocks may fall to 3.1mn-3.2mn t by April, according to crushers' latest data. This would be 1mn t lower than where stocks stood on 1 April 2020 and the lowest level since the 2015-16 marketing season.

The fall in stock levels the result of a 15pc reduction in this year's sunflower seed production, following dry weather conditions. According to Ukraine's ministry of economy, the country harvested 13.1mn t of seeds in the 2020-21 marketing season, while crushers' estimates are a bit lower, at 12.2mn-12.3mn t.

These final 2020-21 production figures differ greatly from initial forecasts, which predicted record levels of 16mn-17mn t. And given these expectations for bumper sunflower seed output at the start of the season, Ukrainian exporters sold significant volumes of sunflower oil and meal on a forward basis, in a bid to protect themselves from a probable decline in prices once this crop came into the market.

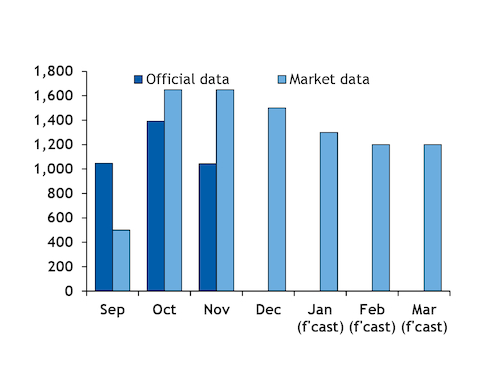

Ukrainian crushing plants consequently ran at full capacity over the first months of the season until 31 August, to provide exporters with large volumes of sunflower oil and meal availability, for the global market. According to official data, Ukraine exported 2.2mn t of sunflower oil and 1.7mn t of sunflower meal from September-December 2020.

To produce these record volumes, Ukrainian crushing plants processed 5.3mn t of sunflower seeds over the same period, while another 3.7mn t of seeds are expected to be crushed in January-March. This will bring the total volume of Ukrainian sunflower seeds crushed in the first seven months of the 2020-21 marketing year to a record 9mn t, up by 500,000t on the year, and equal to nearly 75pc of this season's crush target of 12.2mn t.

As a result, Ukrainian crushers will face tight supply availability starting from April, with only about 3mn t of sunflower seeds set to be left available for crushing for the remainder of the season. And such low stocks could spur rising competition between crushers, pushing local sunflower seed prices higher and reducing crush margins.

This could result in many small and medium-sized crushing plants being forced to suspend their operations until the new crop arrival in September 2021, which will lead to a sharp reduction in sunflower oil and meal supplies from Ukraine in April-August.