Few cargoes scheduled to be loaded in March from US liquefaction facilities have been cancelled, market participants said today.

A maximum of five — although likely to be fewer — cargoes were turned down by offtakers, market participants noted, adding that the total number cancelled was lower than for February.

The deadline for offtakers from US operator Cheniere Energy's 25mn t/yr Sabine Pass and 15mn t/yr Corpus Christi liquefaction facilities to cancel March cargoes passed yesterday. And although March fob prices have remained at ample premiums over feedgas prices to imply an incentive to take the cargoes, concerns around tight shipping availability have remained in recent weeks.

A number of offtakers were heard to have cancelled a total of 7-10 February cargoes by 20 December, after being unable to attain the required shipping capacity to load all of their cargoes. And the differential in des prices between northeast Asian and European markets was wide enough for firms to at least consider turning down some cargoes to ensure that they had the shipping capacity to maximise deliveries into northeast Asia, market participants said.

The strong northeast Asian demand has continued to pull Atlantic basin production into the Pacific so far this winter, tightening the freight market, with US-northeast Asia journeys second only to those for European reloads in their length. Congestion at the Panama Canal, in turn diverting flows through the Suez Canal, even further tightened the market.

This left some offtakers, after the deadline for February cancellations, being scheduled to load early February cargoes at US liquefaction facilities but without the carriers to receive the volumes, market participants said. This forced some to sell their contracted supply on to larger trading firms that were better able to leverage their size to secure some tonnage and deliver into Europe, despite delivery to northeast Asia likely to offer significantly greater returns, because of the shorter journey time to Europe, market participants said. The required charter length to deliver to northeast Asia was simply not available.

And those carriers loading in the US for northeast Asia and delivering through Suez in March are unlikely to be able to return to the US until April, suggesting that March availability could be limited as the freight market focused activity on the period in recent weeks ahead of the cancellation deadline yesterday, with firms seeking to ensure that they would not be left with cargoes that they were unable to load.

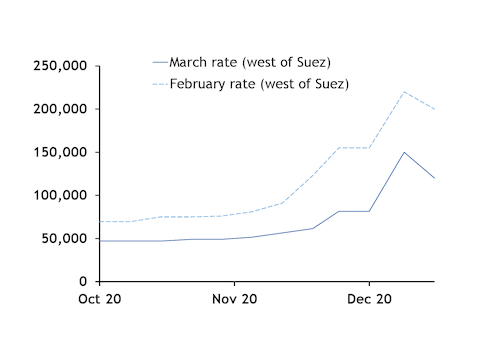

But although the initial jump in March requirements spurred a sharp rise in forward spot charter rates for the period, the volume of open tonnage subsequently stepped higher to meet this demand in the past week, weighing on March charter rates as concerns around a repeat of February's tight freight market dissipated. And quick newbuild deliveries so far this year, with nine already delivered and a further six due to be delivered by the end of February — in time to reach the US by March — has further added to available supply.

There is also a lower incentive for offtakers, particularly from projects operating under a tolling model, to maximise their take in March, compared with a month earlier, which could weigh on production and curb loading demand over the month. The March fob price has remained at a premium to feedgas prices, but is unlikely to be enough to cover all of the liquefaction fee, suggesting offtakers would be able to offset only part of this take-or-pay fee. This could provide an incentive to load only minimum contractual volumes in March, although it is unlikely for February with the fob price holding well above both feedgas and liquefaction costs until the past few days.

The early shift in market activity to March, compared with a month earlier, as well as evident greater vessel availability is likely to have reduced the need for offtakers selling on a des basis to cancel this time around, even if they are yet to find the vessels to load their March US cargoes.