Russia's ministry of industry and trade may suggest to the country's government to consider the reinstatement of a quota system or the introduction of a complete ban on ferrous scrap exports if domestic prices for rebar do not start to move lower, deputy minister Viktor Yevtukhov said on 22 January.

The deputy minister's proposition followed a dispute between Russian steelmakers and constructors/contractors around domestic prices for rebar and other construction steel products, which steeply increased in December and have remained high.

The confrontation was accompanied by complaints filed by industrial associations and unions of constructors, which blamed steel prices for "a fall in the profitability and the economic efficiency in the construction sector, increased production costs, a slowdown in housing commissioning, rising prices in the real estate sector and a decline in taxable profit".

In response, industry association Russian Steel (Russtal) estimated the share of steel products in a square metre of premises at 3–6.5pc, depending on type of building. Russtal argued that this meant any rise in steel prices cannot lead to significant changes in constructors' expenses.

In late December, Russia's anti-monopoly watchdog FAS investigated the validity of high rebar prices and submitted an application to the industry and trade ministry, asking it to impose an interlinked system of duties for ferrous products as a response to the increased duty on ferrous scrap exports. The industry ministry did not support the initiative.

Rebar price to determine scrap policy

Now, the ministry is going to monitor the situation with rebar prices, and if they do not soften as was expected after the scrap export duty was tripled from the end of this month, the ministry will suggest fully restricting ferrous scrap exports.

"About 80pc of the rebar price is the cost of scrap. We have already introduced a limiting measure of the higher export duty. If it does not work, we will propose tougher measures," the deputy minister said.

Ferrous scrap market participants approached by Argus for feedback called the potential introduction of additional export restrictions "illogical", "being unfairly lobbied" and "lacking an economical ground".

"Exporters' purchase prices naturally did increase in the past few months, following an uptrend in export prices as they always do. As soon as this uptrend runs out, the rise in exporters' bids halted — unlike the rise in steelmakers' buying prices, which has been mostly due to poor supply amid lower collection rates, and has often happened at higher rates," a scrap trader said.

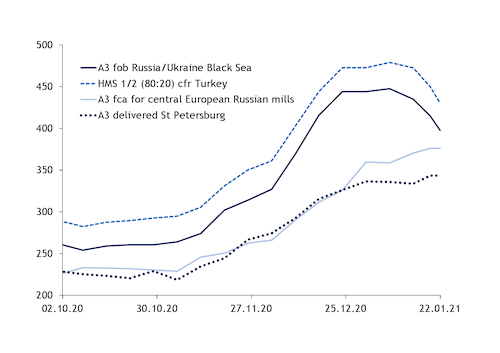

Indeed, ferrous scrap import prices in Turkey — the key outlet for Russian scrap exporters — have been declining over the past two weeks, with the Argus daily HMS 1/2 80:20 cfr Turkey standing at $413/t today, $37/t lower on the week and $68/t down from two weeks ago.

This, along with the raised export duty, prompted exporters in northwest Russia to start trimming buying prices (see graph), but bullish movement in the domestic market induced by Russian mills forced exporters to briefly re-raise dock prices last week. But this week, exporters sharply lowered bids as seaborne markets continued to weaken.

Some steelmakers that boosted buying prices last week continued to hike them this week. In particular, some Urals-based steel producers have added 500 roubles/t ($6.68/t) to previous levels, as their stocks and supplies are still insufficient for their requirement.

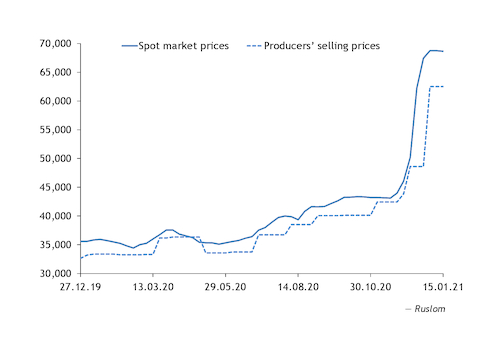

Scrap association Ruslom noticed that the news of the tripled export duty not only failed to cool domestic prices down in January, as expected, but, in contrast, contributed to a sharp rise in domestic rebar prices (see graph).

"After the new duty was announced in the last days of December, the increase of the index price for rebar began to outpace the increase of the index price for scrap. If we take the January 2020 price level as 100pc, then the scrap index was 143pc by mid-December, while the rebar index was 174pc, with the average spot price for rebar in the Moscow region reaching Rbs62,238/t cpt. In the third week of December, the rebar index was already 189pc and exceeded 190pc in early January, while the scrap index was around 173pc," Ruslom said.

"In the Black Sea export markets, rebar price increases developed slower, especially since 7 December, and began to soften in mid-January, while domestic prices were moving up increasingly and have continued to firm. We consider it as the first consequence of the boosted ferrous scrap duty," the association said.