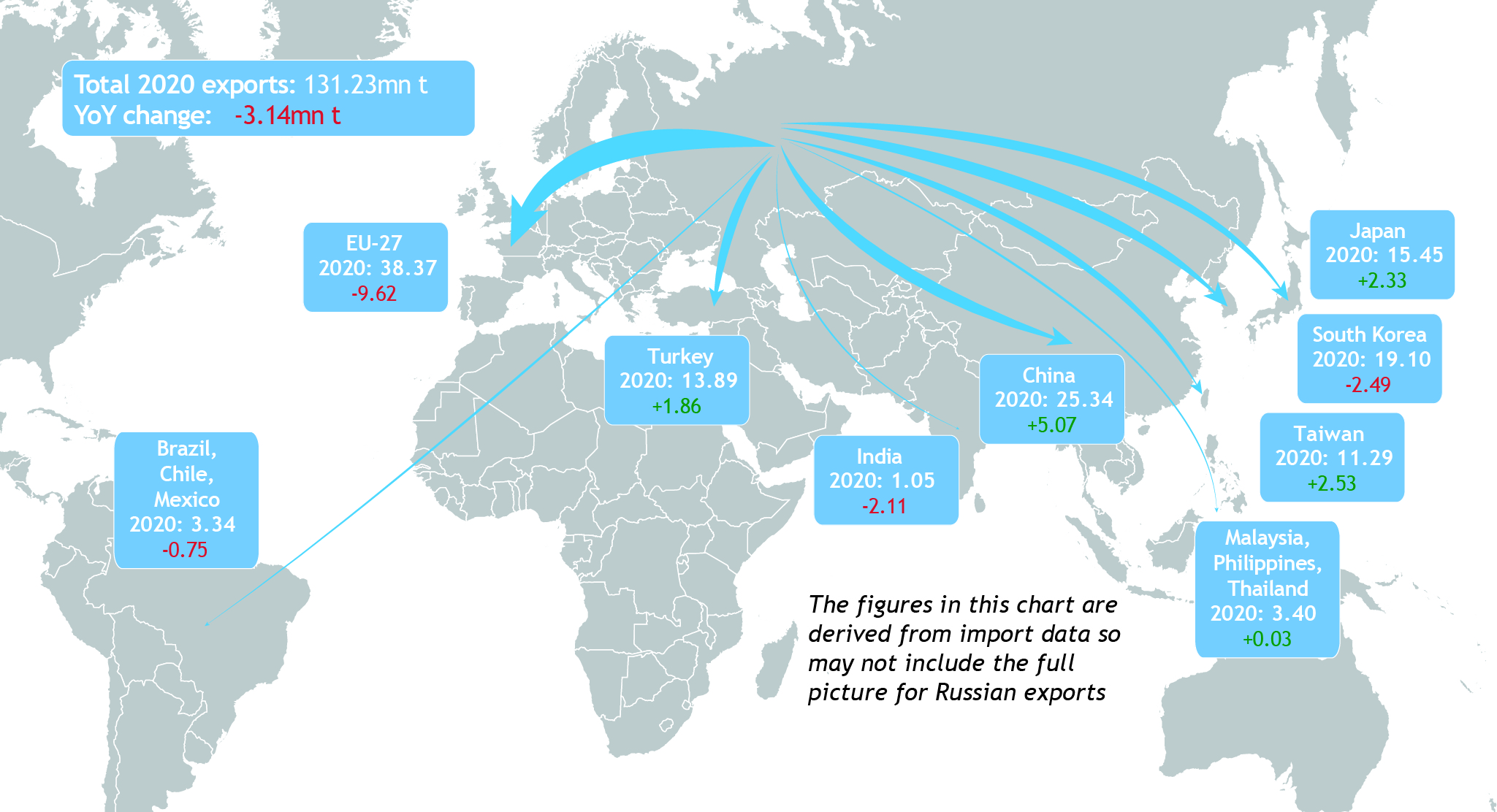

Russian coal exports were practically flat on the year in 2020, as strong July-December demand offset a weak first half.

Shipments for the European market dropped sharply compared with 2019 but recovered in the fourth quarter, as a higher API 2 index and restricted Colombian supply boosted demand for Russian coal.

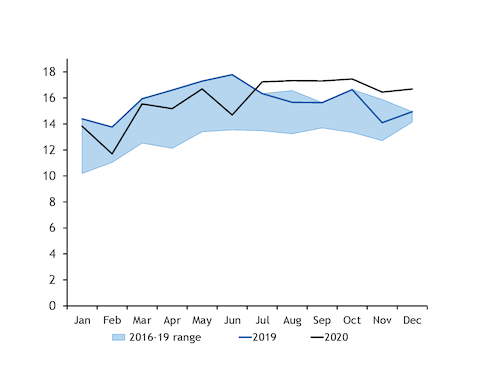

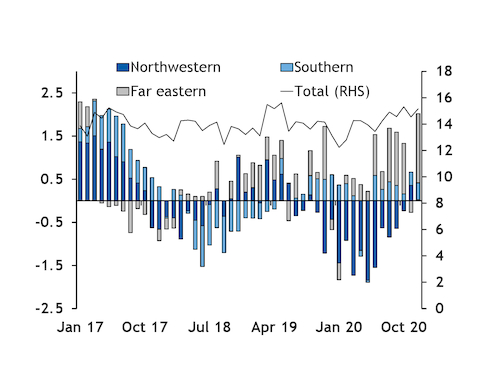

Russia's seaborne coal exports totalled 190mn t in 2020, up slightly from 189mn t in 2019 and 182.2mn t in 2018. Higher exports from far eastern and southern ports offset a decline in flows from northwestern terminals.

Far eastern exports increased by 10.5pc on the year to 107.2mn t, with July-December shipments at 57.2mn t and January-June flows at 50mn t. Demand in the second half of the year grew from key Asian markets, including China, as Russian coal took advantage of Beijing's ban on Australian coal, as well as strong demand from northeast Asia owing to lower than average temperatures.

Customs data show China's thermal coal imports from Russia jumped to a record 4.2mn t in December and 14.6mn t in July-December, up from 10.9mn t a year earlier.

Exports from southern ports grew by 34.8pc on the year to 20mn t, around half of which was shipped from Taman, which has ramped up operations in the past 12 months.

But shipments from northwestern ports, which primarily target the European market, fell by 18.6pc on the year to a four-year low of 62.8mn t. Reduced demand from northwest European buyers owing to competitive gas pricing was exacerbated by sluggish demand related to Covid-19 lockdowns. Argus' cif Amsterdam-Rotterdam-Antwerp (ARA) NAR 6,000 kcal/kg prompt assessment averaged $50.27/t in 2020, down from $60.65/t in 2019 and $91.73/t in 2018.

Strong year-end for European market

Exports from northwestern ports recovered to a 15-month high of 6.2mn t in December, representing the first year-on-year rise since July 2019.

Colombian supply issues, coupled with improved coal-gas switching economics, aided the recovery. And the recent cold snap, which has drawn coal inventories at the ARA coal terminal down to a 52-month low, could encourage restocking demand from utilities early in 2021.

Netbacks for Russian producers have also improved amid the rally in the API 2 index, which should support exports. The netback for NAR 6,000 kcal/kg Kuzbass coal shipped from Ust-Luga has averaged $31.72/t so far in January, up from $21.46/t in the fourth quarter of 2020 and $15.28/t in the third quarter.

But Russian coal is likely to face stiffer competition in the European market this year as Colombian coal availability should be boosted by the return of the Cerrejon and Prodeco operations, which were off line for much of last year. On the other hand, Asia-Pacific prices have opened a wide premium to the API 2 index early in 2021, which could draw volumes from all origins away from Atlantic buyers in the short-term.

December exports from far eastern and southern ports also rose on the year, by 13.4pc and 15.7pc to 8.7mn t and 1.8mn t respectively.

Production falls to four-year low

Russian coal production did not hold up as well as exports in 2020. Mining output slipped by 8.1pc on the year to 401.4mn t, according to energy ministry figures.

Russia's electricity generation fell by 3pc on the year to 1,063TWh, likely a result of a Covid-19 related slowdown and a warmer than average 2019-20 winter.

Nuclear power increased its share of the Russian power mix last year to 20.3pc, up from 19.3pc in 2019, according to state-owned Rosenergoatom. The start up of new units last year boosted Russian installed nuclear capacity to 29.4GW.