German wood pellet production hit a fresh record high in 2020, boosted by an increase in raw material availability, domestic demand and production capacity.

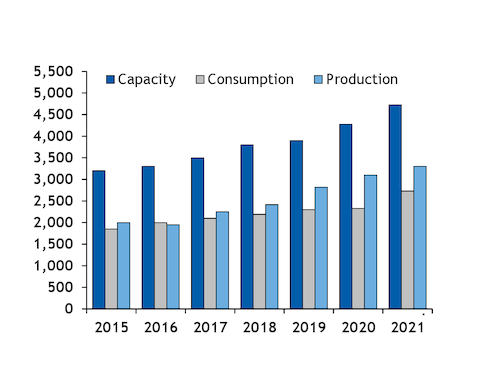

Germany produced 3.1mn t of wood pellets last year, a rise of 9.9pc from 2.82mn t in 2019, data from German biomass association DEPV show. Pellet production reached 810,000t in the fourth quarter of last year, up by 7.7pc on the 752,000t produced in October-December 2019.

And German wood pellet output could reach 3.3mn t by the end of this year, with production capacity set to rise by 450,000 t/yr, according to DEPV.

The vast majority of German pellet production — 97.4pc — is EN Plus-certified, A1-grade quality and about a quarter of its total output is bagged pellets.

Wood chips were the most common raw material used in German pellet production, accounting for 84.9pc last year. This was supplemented by roundwood timber that cannot be sawn, the proportion of which came from damaged wood — caused by bark beetle infestation, as well as drought and fire to a lesser extent.

Domestic demand on the rise

Germany's domestic heating market grew again last year. Sales of new pellet burning systems rose by 78.5pc on the year to 61,850 in 2020.

This was the highest rate of growth of any boiler type or energy source on the German heating market last year.

Overall, there are 546,000t pellet-burning systems installed in Germany, and given the strong growth in pellet boiler and stove installations, DEPV sees reason for a further increase in pellet production in the future, the association's managing director, Martin Bentele, said.

In total, about 11.42TWh of energy was made available in Germany as a result of pellet firing last year, accounting for more than 6pc of renewable heat and 1pc of total heat consumption in the country.

Wood pellet consumption in Germany reached 2.33mn t in 2020, a small 1.3pc increase from the 2.3mn t recorded in 2019. But domestic wood pellet consumption could grow by up to 400,000t this year, DEPV said. The new federal funding scheme for efficient buildings (BEG), which was introduced at the start of 2021, could spark a consumption increase of about 10pc in 2021, DEPV estimates. And in order to implement the CO2 reduction targets tightened by the EU, as part of the Green Deal, significantly more renewable energies would be required on the German heating market, Bentele said. The EU's new Green Deal stipulates a 55pc reduction in greenhouse gas (GHG) emissions by 2030 compared with 1990 levels, up from the original 40pc target.

Oversupply weighs on prices

Mounting production figures last year, coupled with a mild 2019-20 winter, contributed to an oversupplied European premium market going into the latest heating season in 2020-2021.

Germany's key export partner, Italy, a major consumer of residential-grade wood pellets, imported 183,000t of pellets from Germany in the first 11 months of last year, up by 10.9pc on the year.

Italian demand dropped on high temperatures and strong stocks. The Argus spot index for EN Plus-certified, A1-grade bagged wood pellets delivered to northern Italy fell by 11.8pc on the year to average €202.70/t in 2020.

And prices for premium wood pellets in Germany also dipped slightly. The price of premium-grade wood pellets in Germany averaged €237/t in 2020, down by 5.6pc on the year and by 3.5pc on the nine-year average. The average price level recorded in 2020 was the lowest since 2016, when the price of pellets averaged €231/t.

Comparatively, heating oil was 4.8pc more expensive than wood pellets in 2020, while natural gas was 31.2pc more expensive. The price of wood pellets held a premium to the cost of heating oil for seven months in 2020, as values for the latter fell as a result of falling global crude oil prices.