US refiners hope that pent-up summer demand will restore buying interest in fuels undermined by pandemic restrictions and regulatory uncertainty.

Refiners expect accelerating vaccination rates to encourage more consumers to return to the roads. "Certainly by summer, we would expect that a good portion of the American public is able to get out and burn the fuels that we make, and that should lead to a more normal-type summer level," Phillips 66 executive vice-president of refining Bob Herman says.

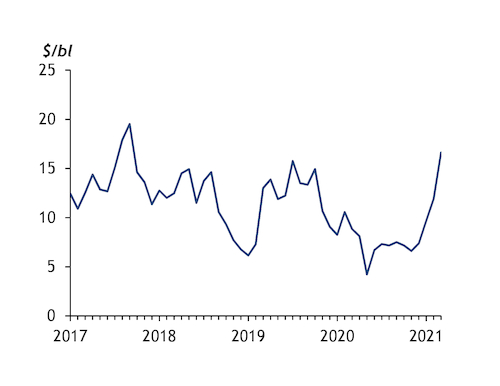

Refining margins have firmed following a sharp drop in throughputs caused by freezing temperatures in February that led to a fall in product stockpiles. Gulf coast gasoline stocks fell by 11mn bl — or 12pc — in a single week in late February, plummeting from unseasonably high levels to below the five-year range. Diesel inventories fell by 6pc to 143mn bl. Gulf coast refining margins have climbed above $16.60/bl this month, the highest monthly average in three and a half years. And the high cost of complying with renewable fuel blending mandates is helping to push margins higher.

But questions remain about underlying demand. US gasoline consumption is lagging pre-Covid levels by about 10pc and demand for crude is likely to remain under pressure. Crude stocks have risen by 35mn bl since mid-February, driven by the refinery disruptions. In the second half of the year, higher fuel demand could draw in more Opec+ barrels and other sour supplies. The more plentiful sour crude supply could widen discounts for the heavy sour grades that much of the country's processing capacity is designed to run.

But overall demand is still likely to wane, given that North American refiners have announced plans to close almost 1.3mn b/d of crude capacity over the next four years. Marginal refiners are at greatest risk. The global collapse in demand has already resulted in the closure of 85,000 b/d of processing at PBF Energy's now 95,000 b/d refinery in Paulsboro, New Jersey, and the permanent shutdown of Shell's 240,000 b/d Convent refinery in Louisiana.

Blending burden

Regulatory pressure could lead to the closure of a further 10pc of crude processing capacity. Pressure is coming from the high cost of complying with federal renewable fuel blending mandates. Costs have climbed above 17¢/USG for gasoline or diesel bound for the domestic market, up from 2.5¢/USG in January 2020, after a court ruling sharply limited the power of the executive to waive the blending requirements.

President Joe Biden's administration said last month that it would follow restrictive guidelines set by a federal court that effectively put an end to the blending exemptions that the previous government granted to dozens of refineries processing less than 75,000 b/d of crude. Refiners have appealed against the court decision in the Supreme Court, which could uphold or reject the tough criteria this year. States warn that the lack of waivers could lead to the closure of small refineries that make up roughly 2mn b/d of the country's capacity.

The high federal compliance costs, increased incentives for low-carbon fuels and a blender tax credit that will expire by 2023 have encouraged refiners to turn to hydrogen-fed units more suited to renewable diesel production rather than crude-fed units. Plans to convert units to renewable diesel production would reduce crude processing by 37,000 b/d at those plants that will continue to refine crude, such as at CVR Energy's 73,000 b/d Wynnewood refinery in Oklahoma. A further 430,000 b/d of capacity could close over the next four years as whole refineries are converted to produce renewable diesel.