Cash generation, not higher output, is the mantra for US shale oil producers, but further cost-cutting and productivity gains are expected to underpin growth.

US shale oil production is not expected to increase any time soon. With Opec+ producers sitting on up to 7mn b/d of unused capacity this year, shale firms refuse to take the bait of higher oil prices and are determined to keep capital spending under control while they focus on reducing costs and high-grading portfolios.

Publicly listed producers in the shale sector kept their capital expenditure constrained to an average of just 55pc of cash flow from operations in the fourth quarter of 2020, consultancy Rystad Energy says, and the proportion of operators that balanced their spending reached a record high of 90pc. Firms are maintaining their commitment to putting rising cash flow towards paying down debt and boosting shareholder returns instead of targeting the output growth of the past.

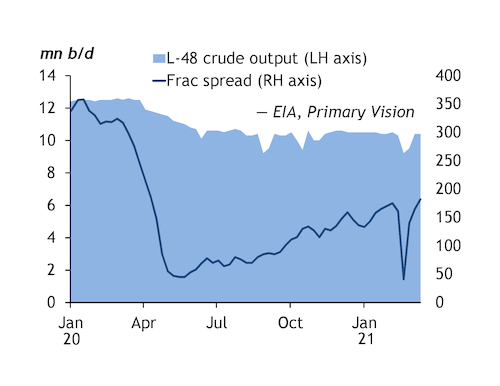

Oil production in the US' lower 48 states has fallen below where it stood at the end of last year, EIA weekly data show (see chart). Output dropped sharply in February, when extreme cold weather paralysed facilities in Texas, and will take time to replace. "We expect to make up a majority of the lost production throughout the year," Diamondback Energy chief executive Travis Stice says.

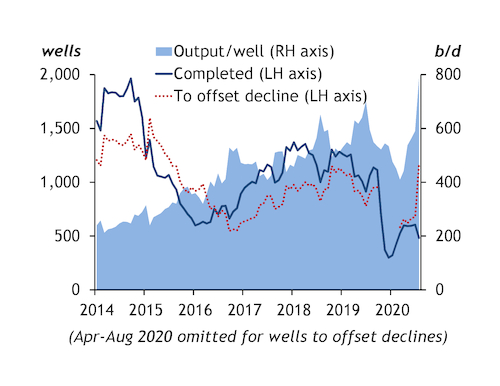

The storms also disrupted new well completions. The number of crews or "frac spreads" active in the shale sector fell to 41 in mid-February compared with 175 at the start of the month, before rebounding to 182 in mid-March, data from industry monitor Primary Vision show. But more completions are still needed to offset legacy declines at existing wells before output can increase again. Production from new well completions averaged around 90pc of legacy declines in September-January, data from the EIA's monthly Drilling Productivity Report indicate (see chart).

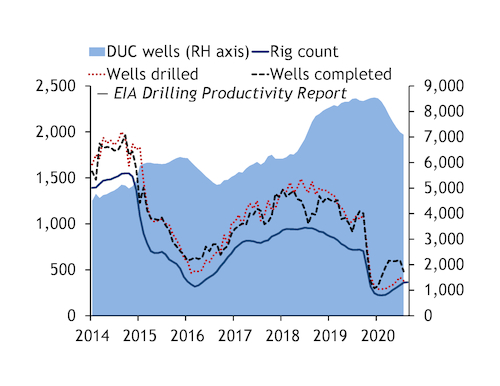

Shale companies plan to be in "maintenance mode" for at least the rest of this year, spending enough to stop output from falling. We "are now running about 24 rigs to support a 2021 programme that will maintain essentially flat oil volumes", EOG chief executive Bill Thomas says.

Yet firms still intend to boost production again once market conditions allow. "Assuming a balanced market by year-end, we are positioned to grow oil by 8-10pc in 2022-23," Thomas says. Pioneer Natural Resources is "committed to the long-term growth rate starting in 2022 and beyond of about 5pc", chief executive Scott Sheffield says. But growth rates are likely to be muted. "The days of hyper-growth in the shale industry should be part of our history, not part of our future," Stice says.

Re-plumbing the Permian

Operators will not relax their tight grip on capital spending but plan to use cost reductions and well productivity gains to deliver growth. Fewer rigs are needed as multiple wells can be drilled from a single pad with much longer laterals. Improvements in drilling management, digital data collection and well completions help cut costs and boost yields. EOG reduced well costs by 15pc last year and expects a further 5pc saving this year. Lease operating expenditure or post-completion costs fell by 22pc in 2020, compared with an 8pc output decline.

Well completion costs are expected to fall sharply in the future as more operators use simultaneous fracking, or "simul-frac", to fracture two or more wells on the same pad at the same time. Pioneer says it reduced the time to complete a four-well pad by about a third on its first attempt. "Simul-frac is incredibly simple," Ovintiv chief executive Doug Suttles says. "This is really about plumbing. It just shows that innovation sometimes isn't all that sexy."